Audio Podcast on Retirement Planning Lingo for Beginners

Dipping your toes into the world of planning for retirement can feel like learning a new language. Terms like 401(k), IRA, vesting, and compounding get thrown around, potentially leaving beginners feeling overwhelmed or intimidated. Don’t let the jargon stop you! Understanding these key terms is fundamental to grasping the core concept of retirement planning and making informed decisions. This simple glossary decodes some of the most common terms you’ll encounter early on. (For a more comprehensive list, check out our guide to basic retirement terminology (Link to 1.4 when created)).

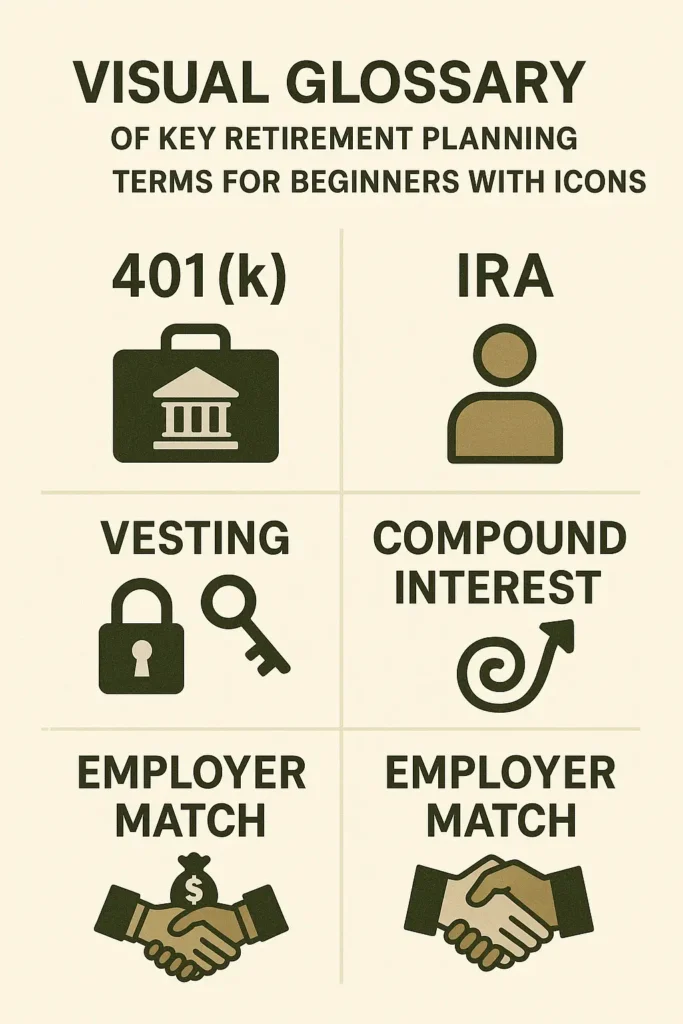

Key Retirement Planning Terms for Beginners

- 401(k) Plan: A retirement savings plan sponsored by an employer. It lets workers save and invest a piece of their paycheck before taxes are taken out (Traditional 401(k)) or after taxes (Roth 401(k)). Employers often match a portion of employee contributions. (See retirement account types – Link to 1.6 when created)

- IRA (Individual Retirement Arrangement/Account): A retirement savings account that you open, separate from your employer. There are two main types:

- Traditional IRA: Contributions may be tax-deductible now, and investments grow tax-deferred. Withdrawals in retirement are taxed as income.

- Roth IRA: Contributions are made with money you’ve already paid taxes on (post-tax). Investments grow tax-free, and qualified withdrawals in retirement are also tax-free. Income limits apply for direct contributions.

- Compound Interest (or Compounding): The process where your investment earnings begin to generate their own earnings. It’s essentially “interest on interest” and is the key driver of long-term wealth growth in retirement accounts. (See Compound Interest – Link to 1.2 when created)

- Employer Match: Money your employer contributes to your 401(k) plan, but only if you contribute too. For example, they might match 50% of your contributions up to 6% of your salary. It’s essentially “free money” towards your retirement. (Link to 1.11 when created)

- Vesting: The process of earning full ownership of your employer’s contributions (like matching funds) in your 401(k). You might need to work for the company for a certain number of years (e.g., 3-5 years) to be fully “vested.” If you leave before being fully vested, you might forfeit some or all of the employer match money. (Link to 1.25 when created)

- Contribution: The money you put into a retirement account. There are annual limits on how much you can contribute.

- Distribution/Withdrawal: Money taken out of a retirement account. Withdrawals before a certain age (usually 59.5) may incur penalties, and taxes often apply depending on the account type.

- Tax-Advantaged: Retirement accounts like 401(k)s and IRAs have special tax benefits (deductions now, tax-deferred growth, or tax-free growth/withdrawals) designed to encourage saving for retirement.

- Asset Allocation: How your retirement savings are divided among different types of investments (like stocks, bonds, cash). This mix is based on your time horizon and risk tolerance. (Link to 1.17/2.3 when created)

- Diversification: Spreading your investments across various asset types and industries to reduce risk. Don’t put all your eggs in one basket! (Link to 1.17/2.5 when created)

- Risk Tolerance: Your ability and willingness to withstand potential drops in your investment value in exchange for potentially higher long-term returns. (Link to 1.18 when created)

Conclusion

Getting comfortable with this basic retirement planning vocabulary is the first step towards taking control of your financial future. While there’s more to learn, understanding these core terms empowers you to ask smarter questions, understand your options (like employer benefits), and feel more confident as you begin your savings journey. Don’t hesitate to look up terms you don’t understand – financial literacy is key!

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸