A Quick Note Before We Begin: My goal at Grow Your Money Smart is to share what I’ve learned on my own financial journey to help you feel more confident about yours. Please remember, I am not a licensed financial advisor, and the information in this article is for educational and informational purposes only. Financial situations are unique; what works for one person may not be right for another. While I do my best to ensure all information is accurate and up-to-date, it should not be considered professional financial advice. Always consult with a qualified financial professional before making any major financial decisions. Your financial future is in your hands, and I’m here to help you get started on the right path.

Contents

- 1 How to Track Your Daily Spending When You’re Too Overwhelmed to Use a Spreadsheet: 5 Systems for the “Non-Budgeter”

- 1.1 1. Understand and Validate the “Ostrich Effect”

- 1.2 2. The Antidote: Restore the “Pain of Paying” with Real-Time Alerts

- 1.3 3. Structural Design: The 3-Account Rule

- 1.4 4. The “One-Number” Safe-to-Spend System

- 1.5 5. Add “Positive Friction” to Curb Impulses

- 1.6 The Bonus Step: The “Grace-Based Reset” Protocol

- 1.7 Your Path to Financial Clarity

How to Track Your Daily Spending When You’re Too Overwhelmed to Use a Spreadsheet: 5 Systems for the “Non-Budgeter”

Does the thought of opening a budgeting spreadsheet make your chest tighten? Do you find yourself avoiding your bank app for days, even weeks, because you’re afraid of what you might see? If so, you’re not alone. This isn’t a character flaw or a sign that you’re “bad with money.” It’s a very human reaction to stress.

Financial clarity is not a reward you get for being good at math. It is a byproduct of designing a system that respects your current emotional bandwidth. The goal isn’t to force yourself into a rigid, complicated system, but to automate financial peace of mind. Let’s explore five simple systems that work *with* your brain, not against it.

1. Understand and Validate the “Ostrich Effect”

When we anticipate bad news—like a lower-than-expected bank balance—our brains can perceive it as a threat. This triggers a release of the stress hormone cortisol. The instinct to avoid looking, often called the “Ostrich Effect,” is a biological attempt to regulate your mood and avoid that cortisol spike. It’s a self-preservation tactic, not a personal failing.

AUTHENTICITY CHECK: It’s a common feeling to want to look away when things get tough. Acknowledging that this is a normal stress response is the first step toward taking back control.

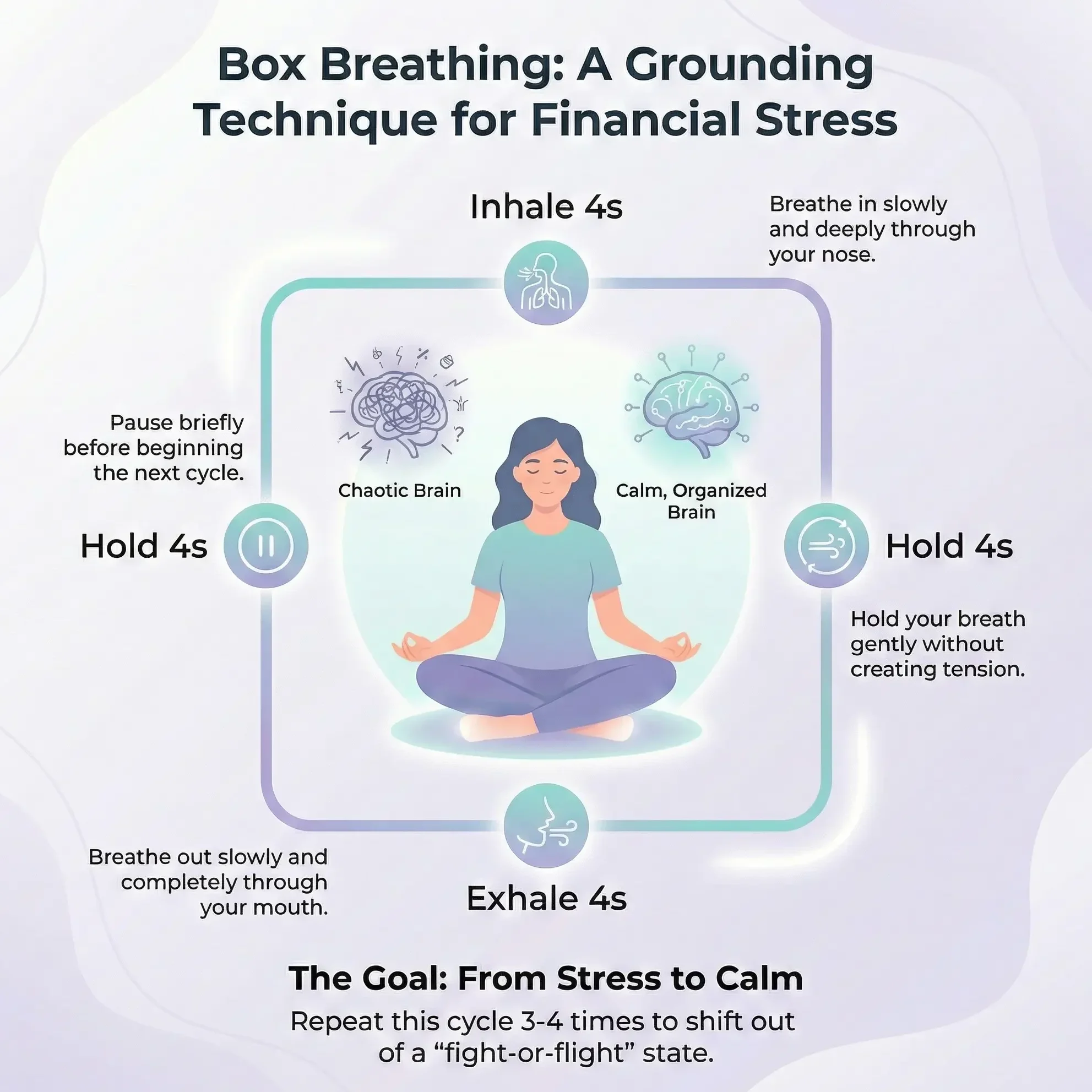

Before you even think about numbers, you need a tool to manage the physical feeling of stress. Here’s a simple grounding technique called Box Breathing:

- ▪︎Breathe in slowly for 4 seconds.

- ▪︎Hold your breath for 4 seconds.

- ▪︎Breathe out slowly for 4 seconds.

- ▪︎Hold your breath for 4 seconds.

Repeat this cycle 3-4 times. This simple act can shift your nervous system out of a “fight-or-flight” state and into a calmer, more logical mindset, making it easier to engage with your finances without the dread.

2. The Antidote: Restore the “Pain of Paying” with Real-Time Alerts

Tapping a card or phone is so seamless that it creates a “spending anesthetic”—we don’t feel the financial impact until much later. The antidote is to create an immediate feedback loop. Instead of manually logging every coffee, let your bank do the work.

Go into your banking app’s notification settings right now and turn on real-time SMS or push notifications for every single transaction. Every time you spend, your phone will buzz. This isn’t to shame you; it’s to make the transaction real and conscious in the moment. It requires zero manual entry and is one of the most powerful habits for building spending awareness.

3. Structural Design: The 3-Account Rule

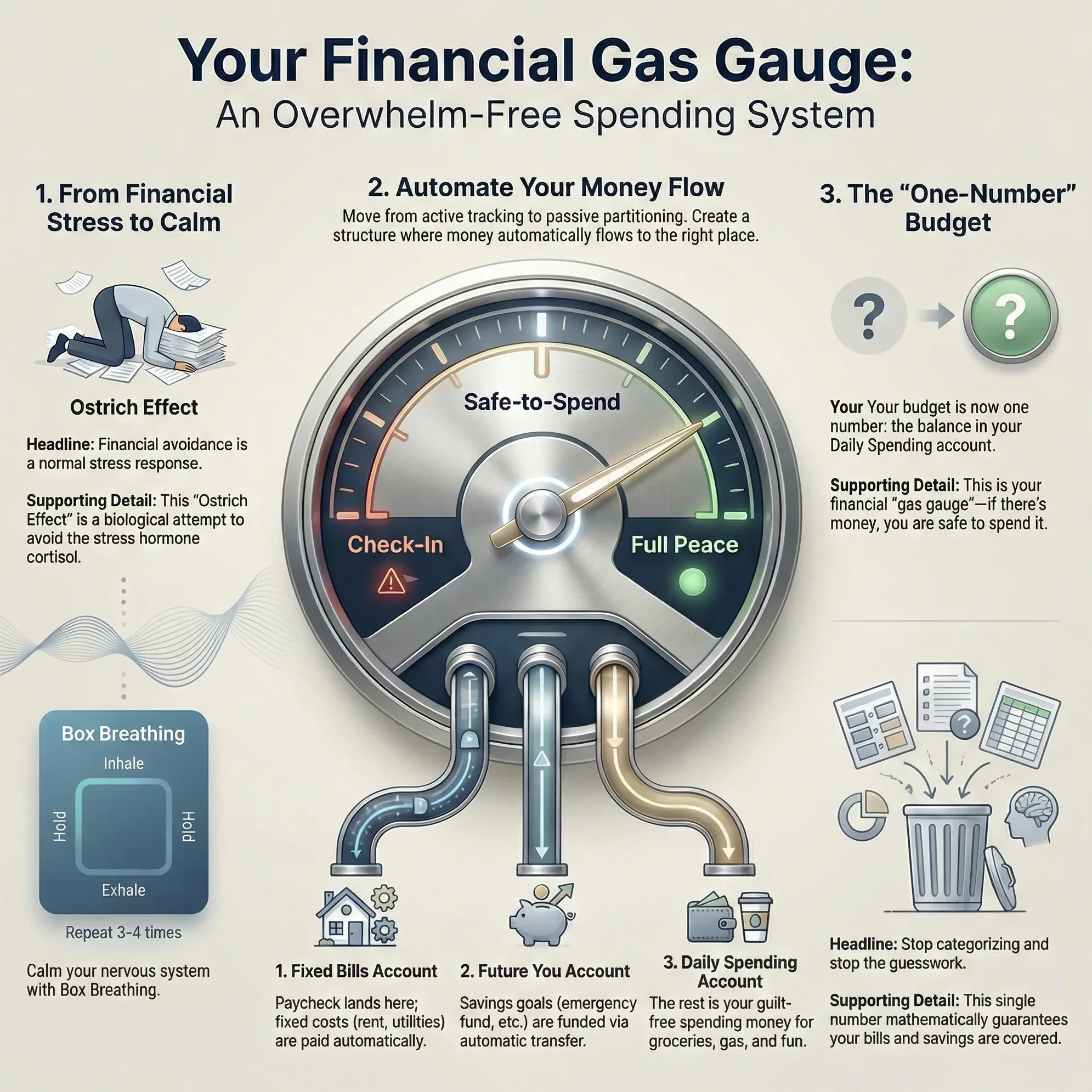

The core of this overwhelm-free system is moving from active tracking to passive partitioning. Forget categorizing every purchase. Instead, design a structure where the right amount of money automatically flows to the right place. This is the 3-Account Rule:

- Account 1: Fixed Bills Account (Checking)This is your financial control center. Your paycheck lands here, and all your fixed, predictable bills are paid from here automatically (rent/mortgage, utilities, car payment, subscriptions). Calculate the total of these bills, add a small buffer (5-10%), and that’s the amount that needs to stay in this account each month.

- Account 2: Future You Account (High-Yield Savings)This is for your savings goals—emergency fund, down payment, retirement. Set up an automatic transfer from your Bills Account to this account for the day after your paycheck hits. Pay yourself first, automatically.

- Account 3: Daily Spending Account (Checking with Debit Card)Whatever is left after your bills are covered and savings are transferred gets moved here. This is your guilt-free spending money for the month. Groceries, gas, coffee, entertainment—it all comes from this account.

AUTHENTICITY CHECK: Many of my readers find that setting up these automatic transfers is the hardest part, but once it’s done, the sense of relief is immediate and powerful.

4. The “One-Number” Safe-to-Spend System

Once your 3-Account Rule is set up, you can stop budgeting. Seriously. Your budget is now just one number: the balance in your Daily Spending Account.

Think of this account like the gas gauge in your car. You don’t judge yourself for the gauge being half-full or nearly empty; it’s just information. It tells you how much fuel you have left to get where you’re going. Your Daily Spending account is your financial gas gauge. If there’s money in it, you are safe to spend it without jeopardizing your bills or savings.

To make it even simpler, divide the starting balance by the number of weeks (or days) until your next paycheck. That’s your weekly (or daily) “safe-to-spend” limit. If you stay under that, the rest of your financial life is mathematically guaranteed to work.

5. Add “Positive Friction” to Curb Impulses

Our modern economy is designed to remove all friction between wanting something and buying it. Your job is to intentionally add some of that friction back in.

- Turn Off One-Click Shopping: Go into your favorite online retail accounts and disable one-click purchasing. Forcing yourself to re-enter your payment or shipping info gives your rational brain a moment to catch up with your impulsive brain.

- Implement a 24-Hour Wait Rule: For any non-essential purchase over a certain amount (say, $50), put it in your cart but don’t buy it. Wait 24 hours. More often than not, the urgent “need” for the item will fade.

The Bonus Step: The “Grace-Based Reset” Protocol

What happens if you fall off track for a few days? The old way was to feel shame, get overwhelmed trying to backtrack and categorize every missed transaction, and then give up entirely. The new way is the Grace-Based Reset.

Give yourself permission to skip it. Do not look back. Don’t try to reconcile the past. Just open your Daily Spending app today, look at the number, and start fresh from there. Your goal is forward progress, not perfect historical accuracy. Breaking the shame spiral is more important than accounting for a week-old latte.

Your Path to Financial Clarity

Building a better financial system isn’t about restriction; it’s about creating freedom. Freedom from stress, freedom from guesswork, and freedom from guilt. By choosing a system that honors your emotional state instead of fighting it, you’re not just managing your money—you’re taking care of yourself.

You don’t need a spreadsheet. You just need a structure. Start with one of these systems today.

Now I’d love to hear from you. Which of these systems feels the most doable for you right now? Share your thoughts in the comments below!

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸