Contents

- 1 A Cautionary Tale: Retirement Scenarios Without Early Planning

- 1.1 Audio Podcast on The Perils of Neglecting Retirement Planning

- 1.2 Scenario 1: Delayed David (Started Saving Seriously at 50)

- 1.3 Scenario 2: Unprepared Uma (Never Prioritized Saving)

- 1.4 Scenario 3: Over-Reliant Owen (Counted on Pension/Inheritance That Shrank)

- 1.5 Common Theme: Lack of Options and Increased Stress

- 1.6 Conclusion

A Cautionary Tale: Retirement Scenarios Without Early Planning

Audio Podcast on The Perils of Neglecting Retirement Planning

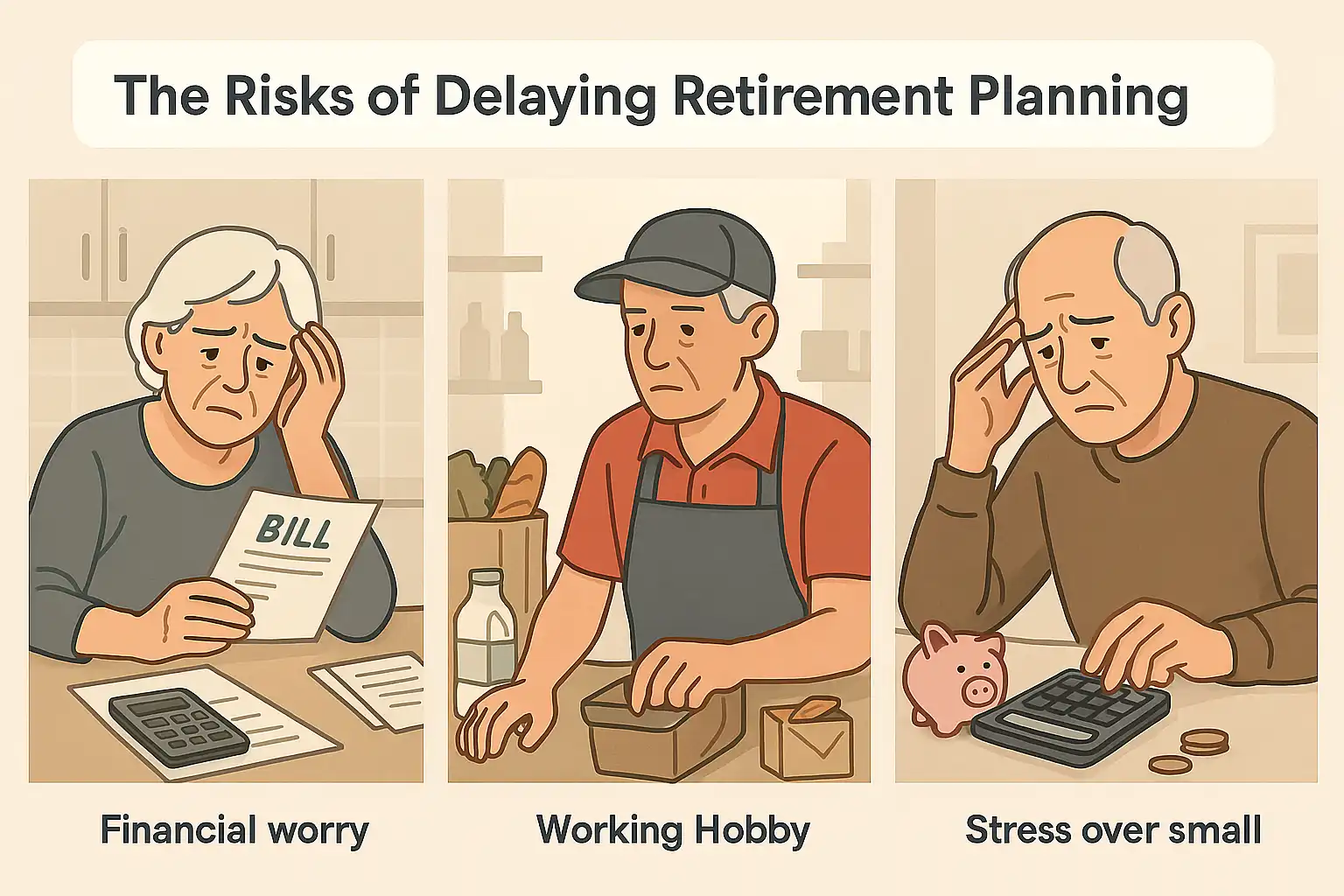

It’s easy to put off retirement planning, assuming things will somehow work out. But neglecting this crucial aspect of financial health often leads to difficult realities later in life. To truly appreciate the importance of the core concept of retirement planning, it helps to visualize the potential consequences of not planning early. Let’s explore some hypothetical, cautionary scenarios. You can contrast these scenarios with positive outcomes achieved through planning to see the dramatic difference proactive saving makes. These illustrate the real risks of not planning.

Scenario 1: Delayed David (Started Saving Seriously at 50)

- Actions: David focused on immediate expenses and lifestyle throughout his 20s, 30s, and 0s. He occasionally contributed small amounts to a 401(k) but often paused savings or didn’t contribute enough for the match. He only got serious about saving at age 50.

- Outcome at 67: Despite aggressive saving in his last 15-17 working years (including catch-up contributions), David missed out on decades of compound growth. His nest egg is significantly smaller than his peers who started earlier. He finds himself relying heavily on Social Security (Link to 1.24 when created).

- Retirement Look: David has to live very frugally. His Social Security covers basic necessities, but there’s little room for travel, hobbies, or unexpected expenses. He worries constantly about outliving his modest savings, especially with potential healthcare costs looming. He may need to consider part-time work well into his 70s just to feel secure. The stress significantly impacts his enjoyment of retirement.

Scenario 2: Unprepared Uma (Never Prioritized Saving)

- Actions: Uma lived paycheck to paycheck, prioritizing current spending and perhaps dealing with debt. Retirement planning always felt overwhelming or unaffordable, so she never consistently contributed to retirement accounts beyond minimal amounts, if any.

- Outcome at 67: Uma has almost no personal retirement savings. Her primary income source is Social Security, which is not enough to cover her expenses comfortably, especially after her spouse passed away (reducing household SS income).

- Retirement Look: Uma faces difficult choices. She may need to sell her home, move in with family (if possible), or rely on government assistance programs. She cannot afford non-essential healthcare, travel, or hobbies. Her retirement is marked by financial insecurity and dependence on others, a stark contrast to the independence she envisioned.

Scenario 3: Over-Reliant Owen (Counted on Pension/Inheritance That Shrank)

- Actions: Owen worked for a company with a pension and expected a sizable inheritance. Believing these would be sufficient, he saved very little personally. Later, his company altered its pension plan during financial difficulties, reducing his expected payout. The anticipated inheritance was also much smaller than expected due to his parents’ long-term care costs.

- Outcome at 65: Owen is shocked to find his combined pension and reduced inheritance, plus Social Security, provide significantly less income than he planned for. He has minimal personal savings to bridge the gap.

- Retirement Look: Owen has to drastically adjust his lifestyle expectations. Planned travel is canceled, hobbies are curtailed. He feels unprepared and possibly resentful that his expected safety nets weren’t as strong as he assumed. He faces the difficult task of trying to catch up later (Link to 1.30 when created) or significantly downsizing his life.

Common Theme: Lack of Options and Increased Stress

The unifying factor in these scenarios is a lack of choice and increased financial stress. Without adequate personal savings built through early and consistent planning, individuals face:

- Inability to retire on their desired timeline.

- Dependence on limited Social Security or unreliable sources.

- Difficulty covering essential expenses, let alone wants.

- Vulnerability to financial shocks (healthcare, inflation).

- Significant anxiety about outliving their money.

Conclusion

These cautionary tales highlight the harsh realities that can arise from neglecting retirement planning. While hypothetical, they reflect the genuine struggles faced by many who didn’t prioritize saving early on. The good news is that by understanding these risks and embracing the core concepts of planning now, you can steer yourself towards the much brighter outcomes illustrated previously and avoid finding yourself unprepared when retirement arrives.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸

1 thought on “What Happens If You Don’t Plan for Retirement?”