A Quick Note Before We Begin: My goal at Grow Your Money Smart is to share what I’ve learned on my own financial journey to help you feel more confident about yours. Please remember, I am not a licensed financial advisor, and the information in this article is for educational and informational purposes only. Financial situations are unique; what works for one person may not be right for another. While I do my best to ensure all information is accurate and up-to-date, it should not be considered professional financial advice. Always consult with a qualified financial professional before making any major financial decisions. Your financial future is in your hands, and I’m here to help you get started on the right path.

Contents

- 1 Which Debt Should I Pay Off First? The “Monthly Breather” Guide to Ending Financial Stress

- 1.1 First, A Nervous System Audit: Why Your Brain Hates Debt

- 1.2 The Hierarchy of Survival: Prioritize Without Panicking

- 1.3 Calculate Your “Breather Score” (The Cash Flow Index)

- 1.4 The “Guilt-Free” 20% Buffer: Why You Need to Live a Little

- 1.5 Answering Your Biggest Anxieties

- 1.6 Special Section: Answering Your Unspoken Questions

- 1.7 A Warning About Digital Debt: The Rise of BNPL

- 1.8 Your First Action Step: Make the Call

- 1.9 You Can Do This

- 1.10 The Monthly Breather Method: Your 4-Step Path to Less Stress

Which Debt Should I Pay Off First? The “Monthly Breather” Guide to Ending Financial Stress

If you’re staring at a pile of bills, feeling like you’re treading water and barely keeping your head above the surface, this article is for you. The constant debate online is usually between the “Debt Snowball” (paying off the smallest balance first) and the “Debt Avalanche” (paying off the highest interest rate first). Both have their merits, but they often miss the most critical element for someone feeling truly overwhelmed: breathing room.

🎧 Audio Player: “The Debt Payoff Method No One Talks About”

When you feel like you’re drowning, you don’t care about the temperature of the water (the interest rate); you care about how fast you can get your head above the surface to take a breath (your monthly cash flow). That’s what this guide is all about. We’re not just going to make a plan; we’re going to make a plan that ends the financial stress and gives you back control, one breath at a time.

Quick Takeaway: The most effective debt payoff plan for beginners isn’t about saving the most money in interest. It’s about freeing up the most monthly cash flow to create momentum and reduce stress.

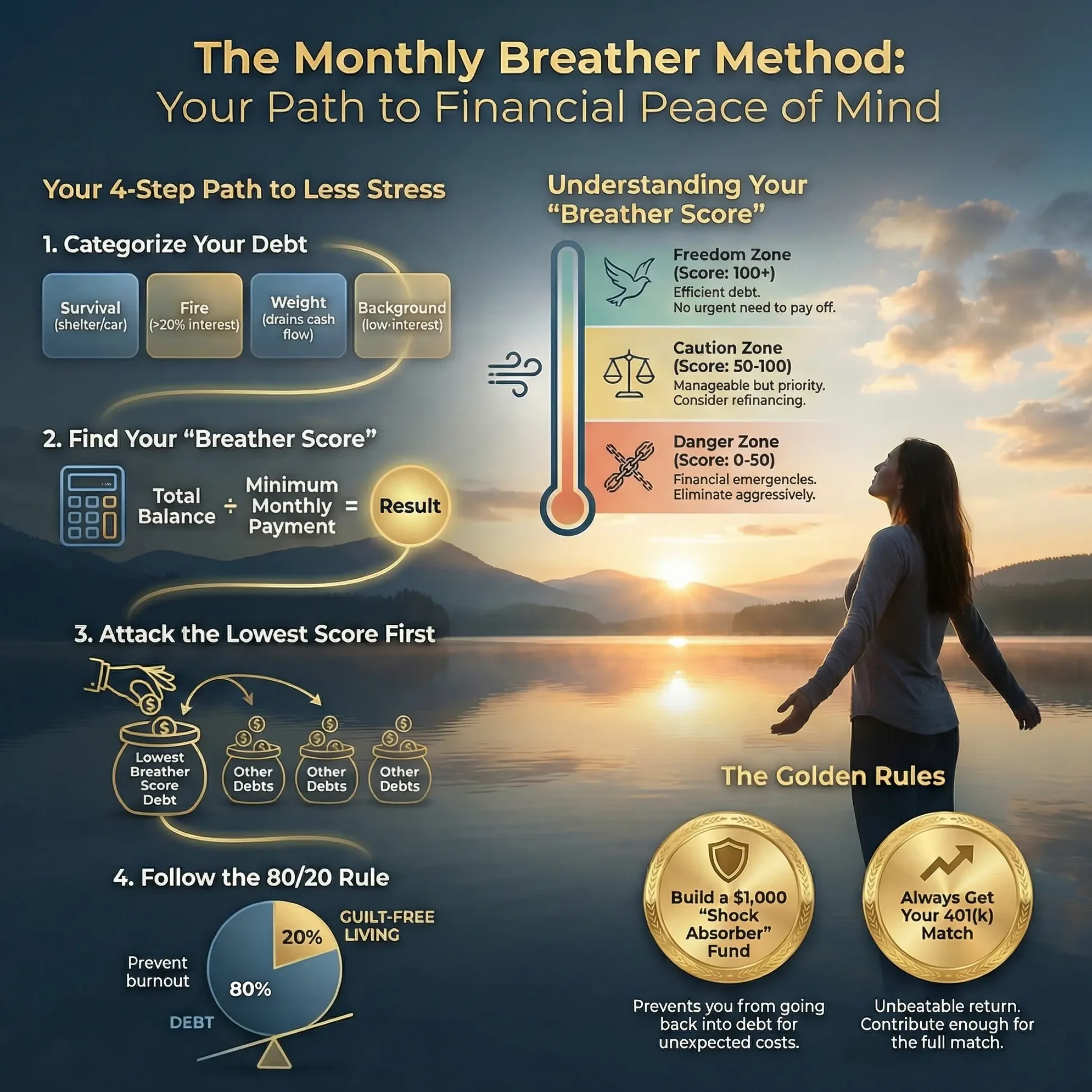

📌 Quick Start: The Monthly Breather Method

If debt feels suffocating, start here.

- Sort your debts into 4 levels Survival → Fire → Weight → Background.

-

Calculate each debt’s Breather Score

Balance ÷ Minimum Payment = Breather Score.

Lower score = higher priority. - Attack the lowest score first Pay minimums on everything else. Free up cash flow fast.

-

Use the 80/20 rule

80% of extra money → debt.

20% → guilt-free living to prevent burnout.

Goal: Create monthly breathing room first—momentum comes next.

First, A Nervous System Audit: Why Your Brain Hates Debt

Before we even look at a single number, let’s acknowledge something crucial. That feeling of dread when a bill arrives? The tendency to avoid opening your banking app? That isn’t a character flaw. It’s biology.

AUTHENTICITY CHECK: It’s a common feeling to want to just ignore it all and hope it goes away.

Financial stress triggers the amygdala, the part of your brain responsible for the “fight, flight, or freeze” survival response. For most people, overwhelming debt puts them in a state of “freeze.” You feel paralyzed, unable to act, which only makes the problem worse. The first step is to move from that state of paralysis to a state of calm, intentional action. This guide is designed to do exactly that, with radical empathy for where you are right now.

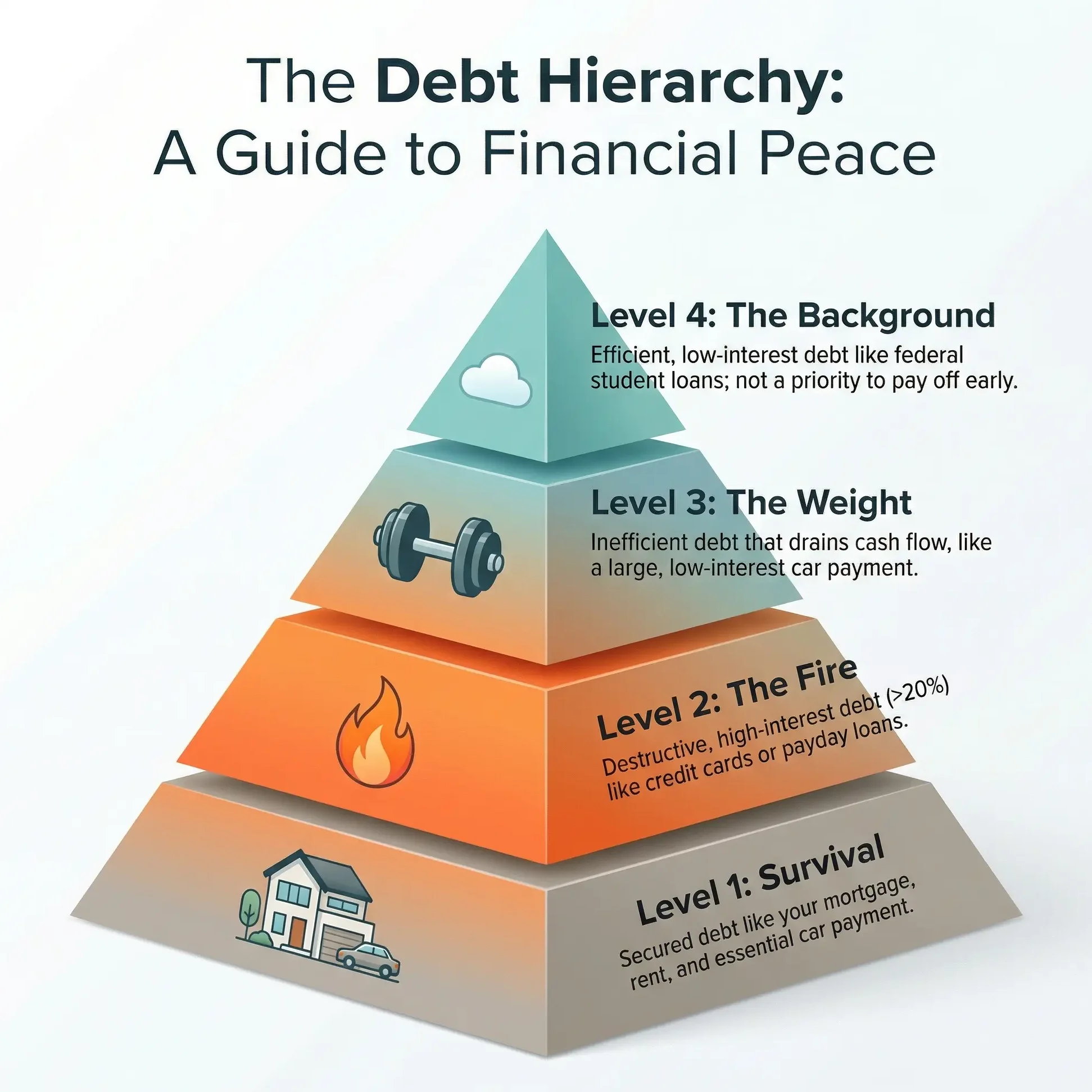

The Hierarchy of Survival: Prioritize Without Panicking

To reduce anxiety, we need to stop looking at debt as one giant, terrifying monster. Instead, let’s categorize it into a clear hierarchy. This tells your brain what truly needs immediate attention and what can wait, instantly lowering the mental load.

- 🏠Level 1: Survival (Secured Debt) This is the absolute priority. It includes your mortgage or rent and your primary car payment. The goal here is simple: pay the minimums required to keep your shelter and essential transportation.

- 🔥Level 2: The Fire (High-Interest Unsecured Debt) This is any debt with an interest rate that feels like a house fire—think credit cards, payday loans, or personal loans with rates over 20%. This debt is actively destructive and costs you a fortune. We must put the fire out.

- 🏋️Level 3: The Weight (Inefficient Debt) This is the debt that feels heavy. It might not have a terrifying interest rate, but it drains your monthly cash flow. Think of a large car payment on a low-interest loan or a store credit card with a high minimum payment relative to its balance.

- ☁️Level 4: The Background (Efficient Debt) This is “good” debt, if there is such a thing. It’s typically low-interest (like a federal student loan or a mortgage) and doesn’t need to be paid off early. It’s just humming along in the background.

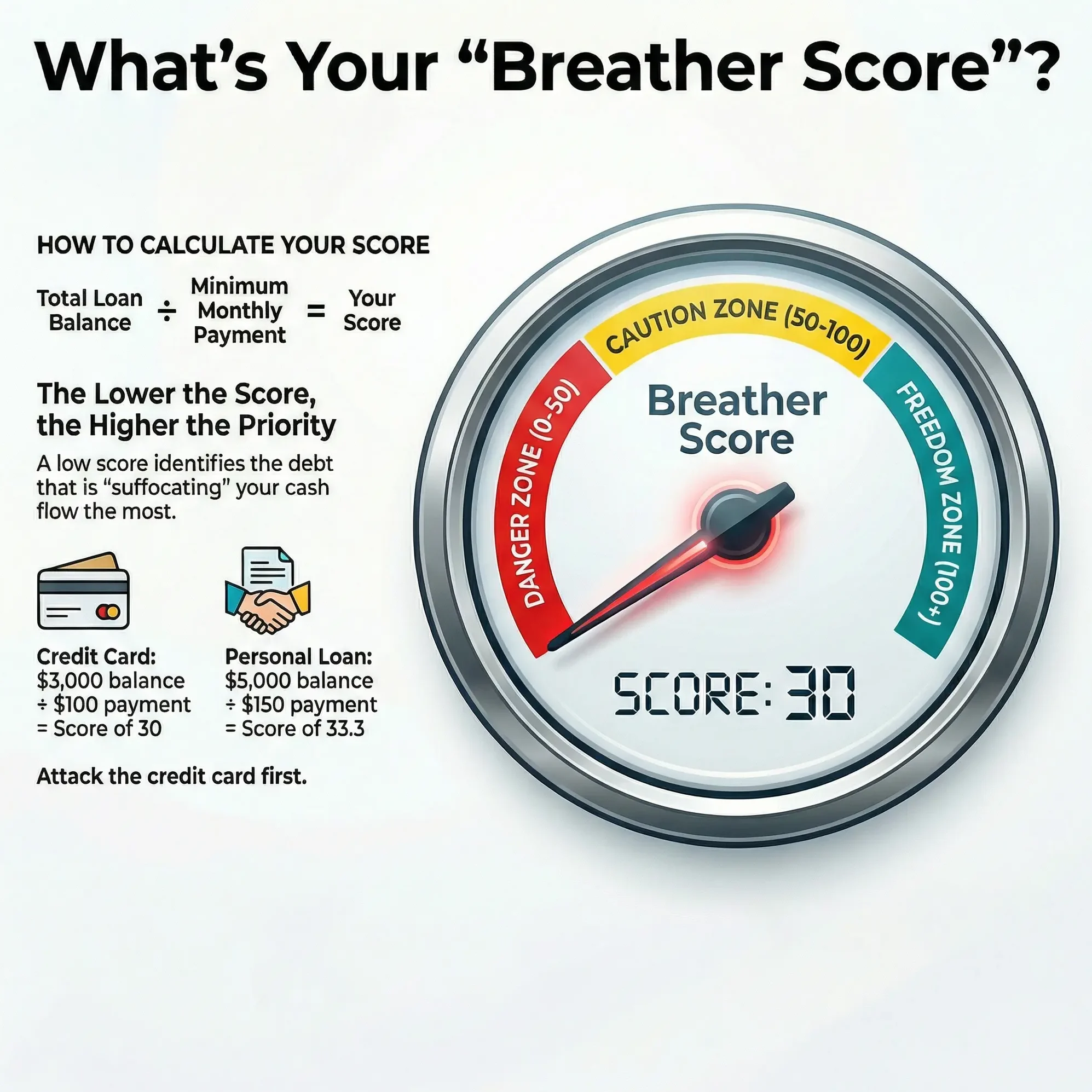

Calculate Your “Breather Score” (The Cash Flow Index)

Now for the core of the Monthly Breather method. Forget the interest rate for a moment. We’re going to find which debt is suffocating your monthly budget the most. We do this by calculating its Cash Flow Index, or what I call your “Breather Score.”

Total Loan Balance / Minimum Monthly Payment = Your Breather Score (CFI)

Let’s say you have two debts:

- Credit Card: $3,000 balance / $100 minimum payment = Breather Score of 30

- Personal Loan: $5,000 balance / $150 minimum payment = Breather Score of 33.3

Even though the personal loan has a higher balance, the credit card has a lower (and therefore worse) Breather Score. It is the most inefficient debt. It’s a “money hog,” taking up a huge chunk of your cash flow for its size. This is the debt you attack first with every extra dollar you have.

Understanding Your Scores:

- 🚨Danger Zone (0-50): These debts are financial emergencies. They are robbing you of your monthly financial flexibility. The goal is to eliminate these with extreme prejudice.

- ⚠️Caution Zone (50-100): These debts are manageable but should be a priority. Consider refinancing or restructuring if possible to improve their score.

- ✅Freedom Zone (100+): This is efficient debt. Your mortgage might have a score of 300+. There is no urgent need to pay this off early. Focus your firepower elsewhere.

The “Guilt-Free” 20% Buffer: Why You Need to Live a Little

One of the biggest mistakes people make is adopting a “scorched earth” policy. They cut out every single joy from their life to throw all their money at debt. This works for a few months, and then the “rubber band effect” kicks in. You feel so deprived that you snap and go on a spending binge, erasing all your progress.

A more sustainable approach is the 80/20 split. If you find an extra $200 in your budget each month, don’t put it all toward debt.

- 💰$160 (80%) goes toward your lowest Breather Score debt.

- ✨$40 (20%) goes into a “Life Happens” fund. Use it for a guilt-free dinner out, a movie, or save it for a few months for a weekend trip.

This buffer prevents burnout and keeps you in the fight for the long haul.

Answering Your Biggest Anxieties

When you’re dealing with debt, other financial fears love to pop up. Let’s tackle the “Big Three” head-on.

1. “What about my retirement?”

This is non-negotiable: If your employer offers a 401(k) match, you MUST contribute enough to get the full match. It is free money and an instant 100% return on your investment. No debt payoff strategy can beat that. Only consider pausing *extra* contributions beyond the match if you have debt in the “Fire” category (20%+ interest).

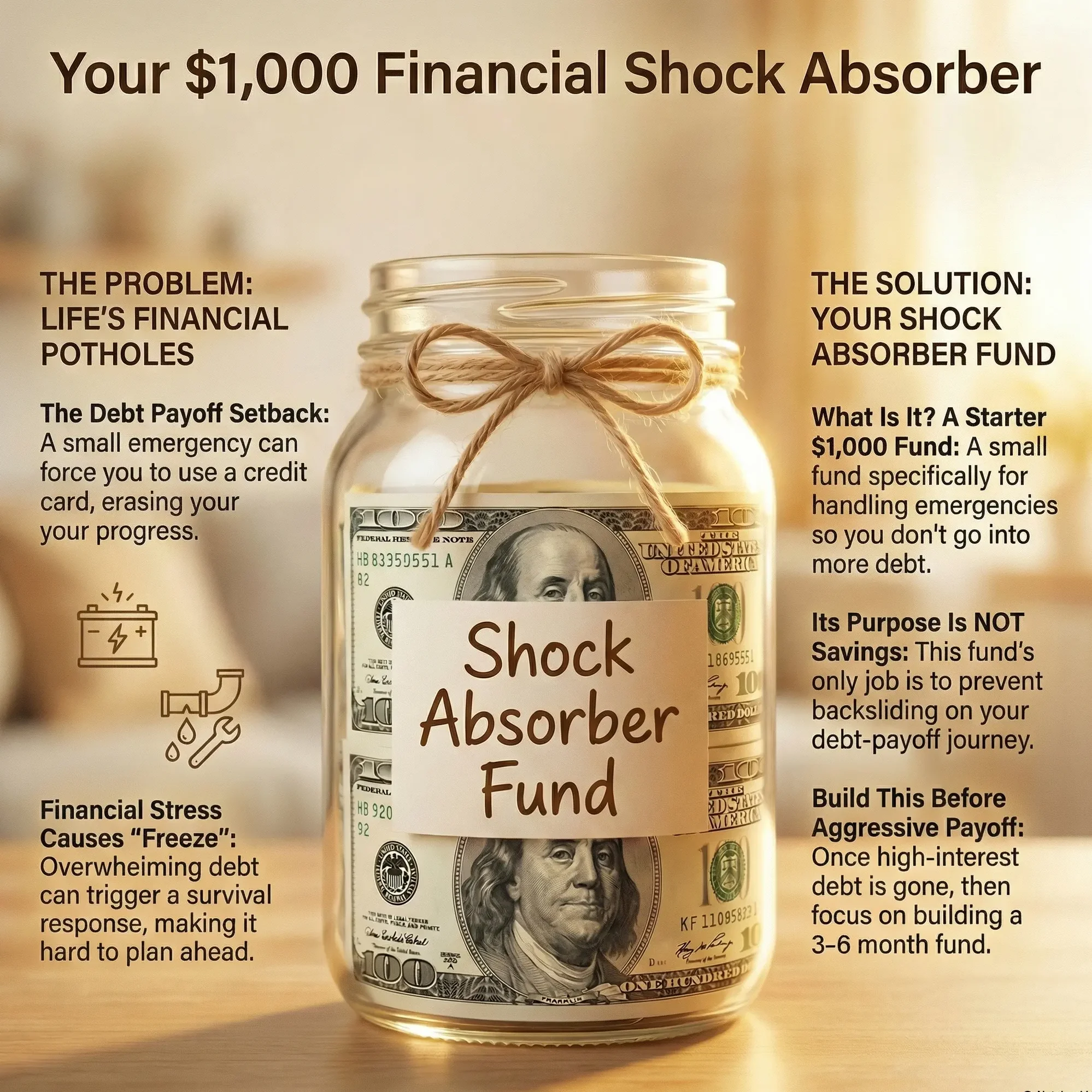

2. “Shouldn’t I build a big emergency fund first?”

A huge emergency fund can feel out of reach. Instead, start with a $1,000 “shock absorber” fund. This isn’t for saving; it’s to prevent backsliding. When the car battery dies or the dishwasher leaks, this $1,000 keeps you from having to put the emergency on a high-interest credit card, restarting the cycle. Once your high-interest debt is gone, you can focus on building that fund to 3-6 months of expenses.

3. “Is this destroying my credit score?”

Actually, this process will *improve* your credit score significantly. One of the biggest factors in your score (about 30%) is your “credit utilization ratio”—how much of your available credit you’re using. As you pay down balances, your utilization drops, and your score will rise. Think of it as leveling up your financial character sheet.

Special Section: Answering Your Unspoken Questions

Sometimes the most stressful questions are the ones we’re afraid to ask.

“I have $10k in debt and I can’t sleep.”

You are not alone. The first step to sleeping better is to make a concrete, actionable plan. Tonight, don’t just worry. Do this: Write down every single debt you have. The company, the balance, the minimum payment, and the interest rate. Then, calculate the Breather Score for each. Just seeing it on paper, organized and ranked, will give you a feeling of control that you don’t have right now. You’ve just turned a monster in the dark into a checklist you can conquer.

“How do I pay off debt when I have ADHD?”

The key is to make the process visual, automated, and rewarding. The Breather Method helps by giving you one single target to focus on. Here are some extra tips:

- 🤖Automate Everything: Set up automatic minimum payments on all debts so you never miss one. Then, set up a separate, automatic weekly transfer to your primary debt target.

- 🎮Gamify It: Use a visual tracker. Get a paper chain and remove one link for every $100 you pay off. Create a “Debt Graveyard” poster where you paste the logo of each company you pay off. Your brain craves these small, tangible wins.

- 🎯Set Micro-Goals: Celebrate every 25% of a debt paid off. At the 25% mark, let yourself use that month’s 20% buffer on something fun. This creates dopamine hits that keep you motivated.

“Is it okay to travel or have fun while paying off debt?”

Yes. A thousand times, yes. Remember the 80/20 rule. A life of total deprivation is not a life; it’s a prison sentence. A budget isn’t about restriction; it’s about permission. It gives you permission to spend guilt-free on the things you’ve planned for. Saving up your 20% buffer for a few months to take a modest trip can be the very thing that gives you the energy to keep going.

A Warning About Digital Debt: The Rise of BNPL

Be extra cautious of “Buy Now, Pay Later” services like Affirm, Klarna, and Afterpay. While they seem harmless, they create a “death by a thousand cuts.” Instead of one credit card bill, you now have 5, 10, or 15 small, individual payment plans, each with its own due date. This dramatically increases your cognitive load, making it easy to miss a payment and get hit with fees. If you have these, list them all out and attack them as part of your plan. They often have Breather Scores in the Danger Zone.

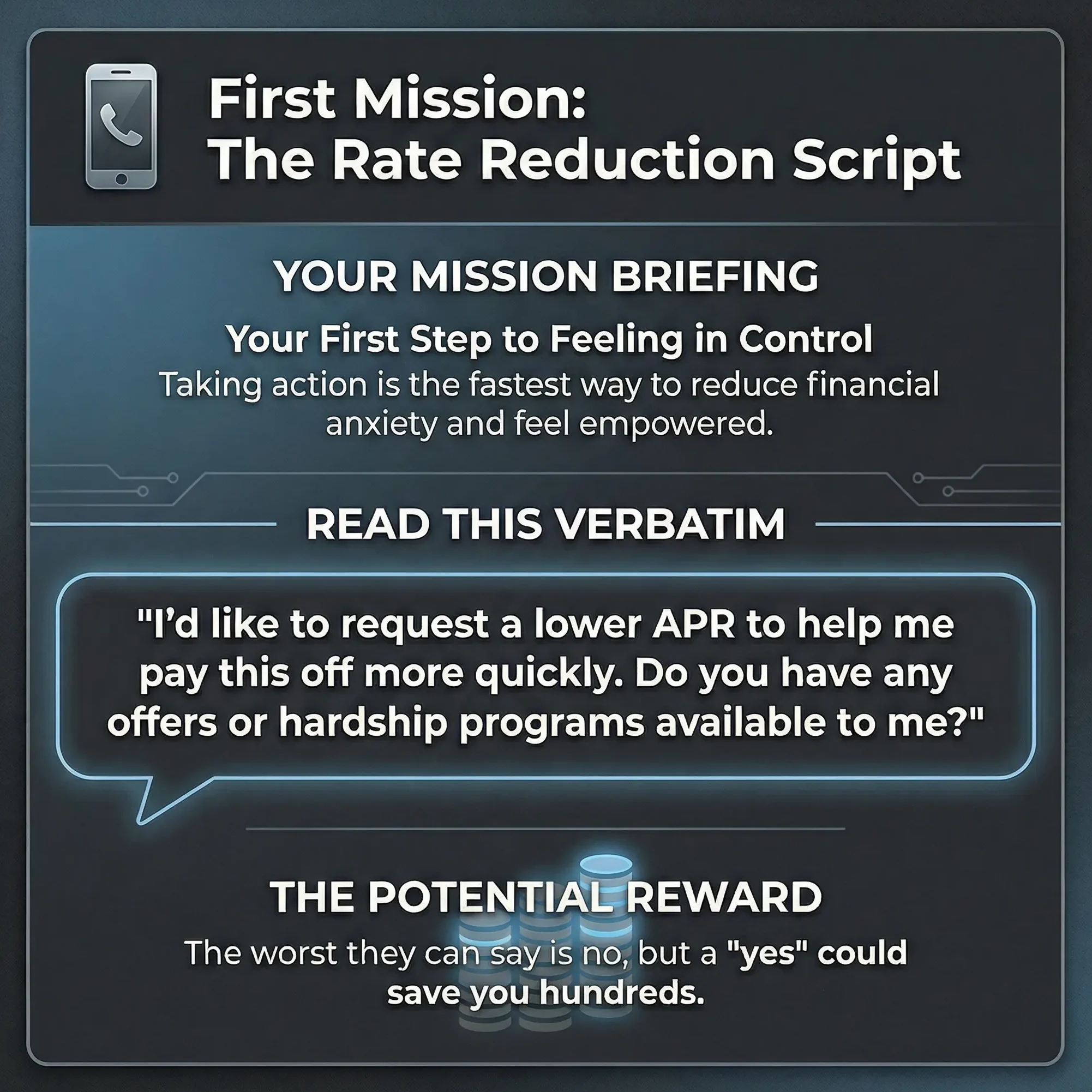

Your First Action Step: Make the Call

Taking action is the fastest way to reduce financial anxiety. Your first mission is to call the creditor of your highest-interest credit card (your “Level 2 Fire”) and ask for a lower rate. Many people are terrified to do this, but it often works.

AUTHENTICITY CHECK: Many of my readers find that just making the call, even if the answer is no, makes them feel empowered.

“Hi, my name is [Your Name] and I’ve been a customer for [X] years. I’m focused on paying down my balance and I’m finding my current interest rate of [Your Rate]% is making that difficult. I’ve been a loyal customer and I’d like to request a lower APR to help me pay this off more quickly. Do you have any offers or hardship programs available to me?”

The worst they can say is no. But if they say yes, you’ve just saved yourself hundreds or even thousands of dollars.

You Can Do This

This journey isn’t about numbers on a spreadsheet; it’s about reclaiming your peace of mind and your future. By focusing on your monthly breather, you’re not just paying off debt—you’re buying back your life, one payment at a time. You are in control.

Now, I want to hear from you. What’s the one debt that’s causing you the most stress right now? Let’s talk about it in the comments below.

The Monthly Breather Method: Your 4-Step Path to Less Stress

1

Categorize Your Debt

Sort into 4 levels: Survival (Home/Car), The Fire (>20% interest), The Weight (Drains cash flow), The Background (Low-interest).

2

Find Your ‘Breather Score’

Formula: Total Balance ÷ Minimum Payment = Breather Score. Lower score = higher priority.

3

Attack the Lowest Score

Pay minimums on others. Direct all extra money to the debt with the lowest Breather Score to free up cash flow quickly.

4

Live with the 80/20 Rule

Use 80% of extra money for debt, 20% for guilt-free living to prevent burnout.

The Golden Rules:

Maintain a $1,000 “shock absorber” fund and always contribute enough for the full employer 401(k) match.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸