Contents

Financial Advisor for Basic Retirement Planning: Necessary or DIY?

Audio Podcast on Retirement Planning: Advisor or DIY?

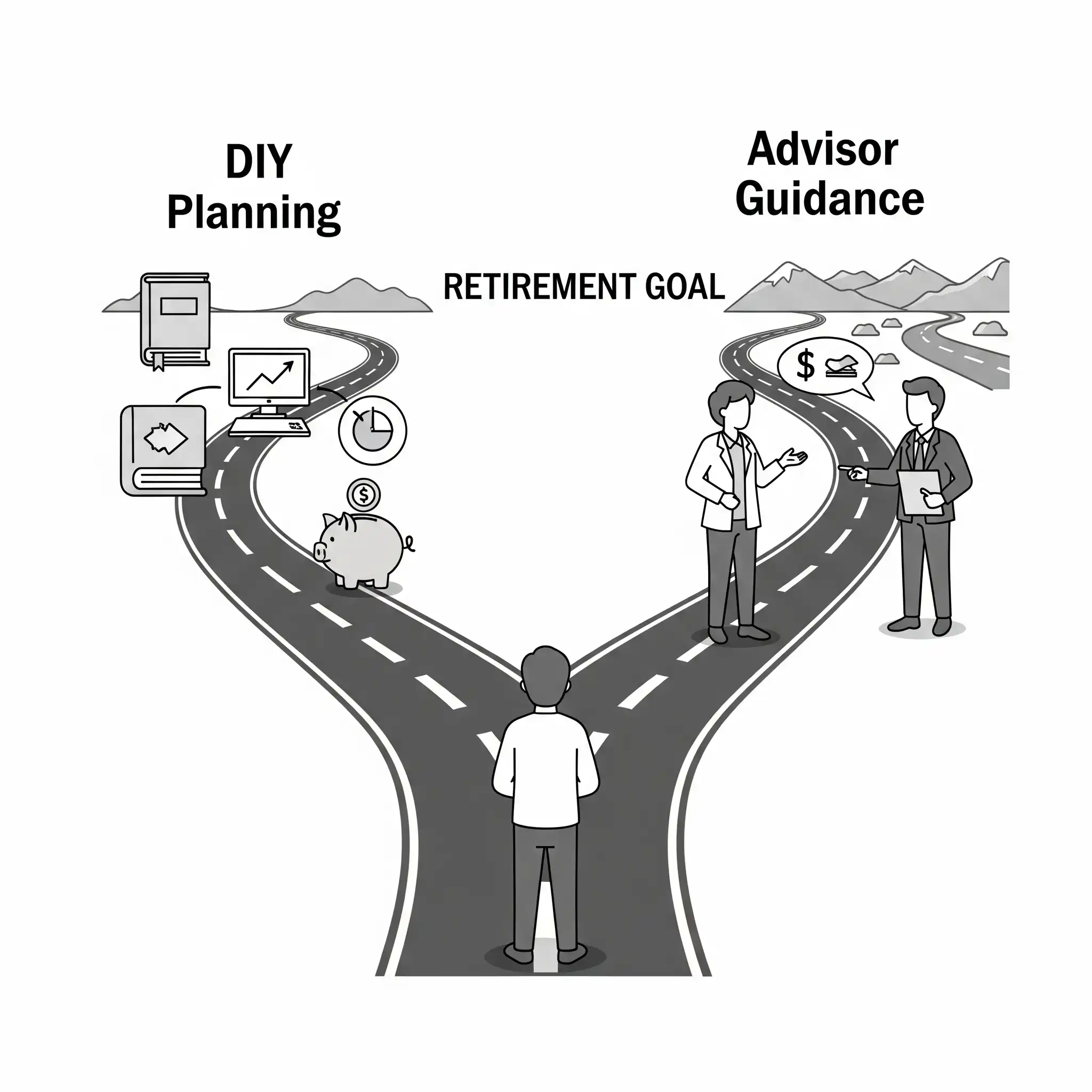

As you begin to explore basic retirement planning, a common question arises: “Do I need to hire a financial advisor right now?” With a wealth of information available online, it can be tough to know when professional guidance is truly necessary. The answer, especially for beginners, is nuanced. While many can confidently start their journey on their own, a good advisor can provide immense value at certain stages. This article will help you understand when you can DIY and at what point professional advice might be a smart move.

The DIY Path: When You Can Confidently Go It Alone

For those just starting out with straightforward financial situations, managing basic retirement planning is very achievable. You can likely go the DIY route if your primary goals are:

- Opening your first 401(k) or IRA.

- Contributing enough to get your employer match.

- Investing in simple, low-cost options like target-date funds or broad market index funds. (Link to 1.19/1.20 when created)

- Learning the fundamentals of saving and budgeting.

The accessibility of online brokerage platforms, plentiful educational resources (like this site!), and simplified investment products have empowered more people than ever to start saving effectively on their own.

When an Advisor Adds Value: The Pros

As your life and finances grow more complex, the benefits of a professional advisor become more pronounced. An advisor is more than just an investment picker; they are a long-term strategic partner.

- Personalized Roadmap: An advisor goes beyond online calculators to create a detailed financial plan tailored to your specific goals, income, family situation, and risk tolerance.

- Behavioral Coach: This is one of their most valuable roles. A good advisor helps you stay disciplined during market downturns, preventing panic selling, and keeps you focused on your long-term plan. They help you avoid common pitfalls driven by emotion.

- Expertise in Complexity: When you start dealing with stock options, multiple properties, business ownership, or more complex financial situations (Link to 5.5 when created), an advisor’s expertise is invaluable.

- Objectivity: They provide an unbiased, third-person perspective on your financial decisions, which can be hard to achieve on your own.

Potential Downsides to Consider

- Cost: Advisors are not free. Fees can be structured as a percentage of assets under management (AUM), a flat annual fee, or an hourly rate. These costs can add up, so it’s important to ensure the value you receive justifies the expense.

- Finding the Right Advisor: It’s crucial to find a qualified, trustworthy advisor. Look for a fiduciary, who is legally obligated to act in your best interest.

Conclusion: A Hybrid Approach

For most people starting their retirement planning journey, a financial advisor isn’t necessary for the initial steps. Focus on mastering the basics yourself: create a budget, sign up for your 401(k), get the full employer match, and open an IRA.

As your assets grow, your income increases, and your life becomes more complicated (marriage, kids, home ownership), consider seeking professional advice. You might start with a one-time plan or hourly consultation. Later, as you approach retirement or need comprehensive management, building a financial team (Link to 5.30 when created) with an ongoing relationship might be the best path. The key is to recognize that you can start strong on your own, and professional help is a powerful tool to utilize as your needs evolve.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸