Contents

What is Your Time Horizon? The Most Important Concept in Retirement Planning

Audio Podcast on Investment Time Horizon: A Simple Guide

When you start delving into the core concept of retirement planning, you’ll encounter a simple yet profoundly important idea: the time horizon. More than almost any other factor, your time horizon dictates your investment strategy (Link to 1.17 when created), how much risk you can take (Link to 1.18 when created), and the potential for your money to grow. Understanding this concept is fundamental to making smart decisions in all aspects of your long-term planning.

What is a Time Horizon?

In investing, a time horizon is simply the length of time you expect to hold an investment before you need to withdraw the money. For retirement planning, this breaks down into two main phases:

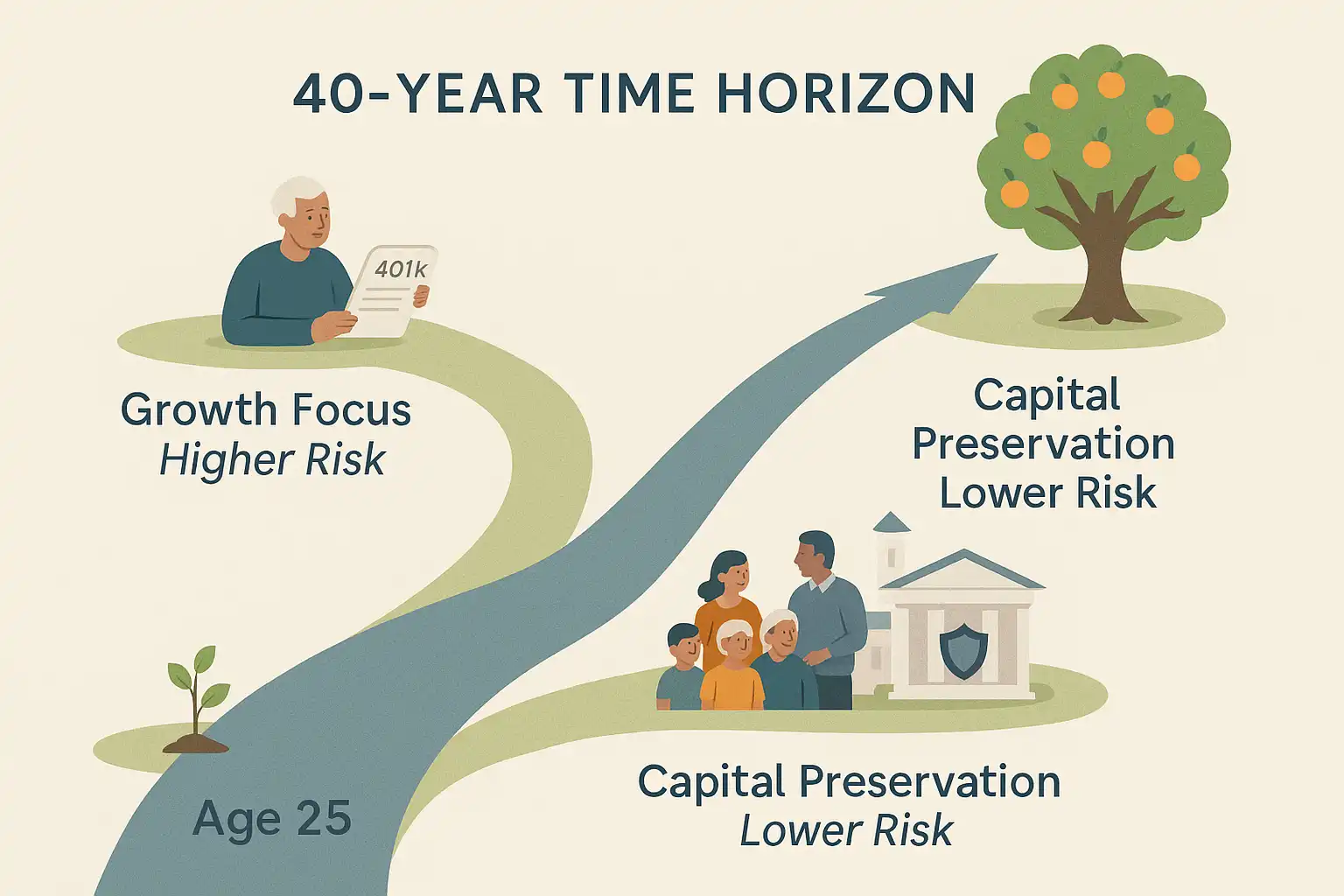

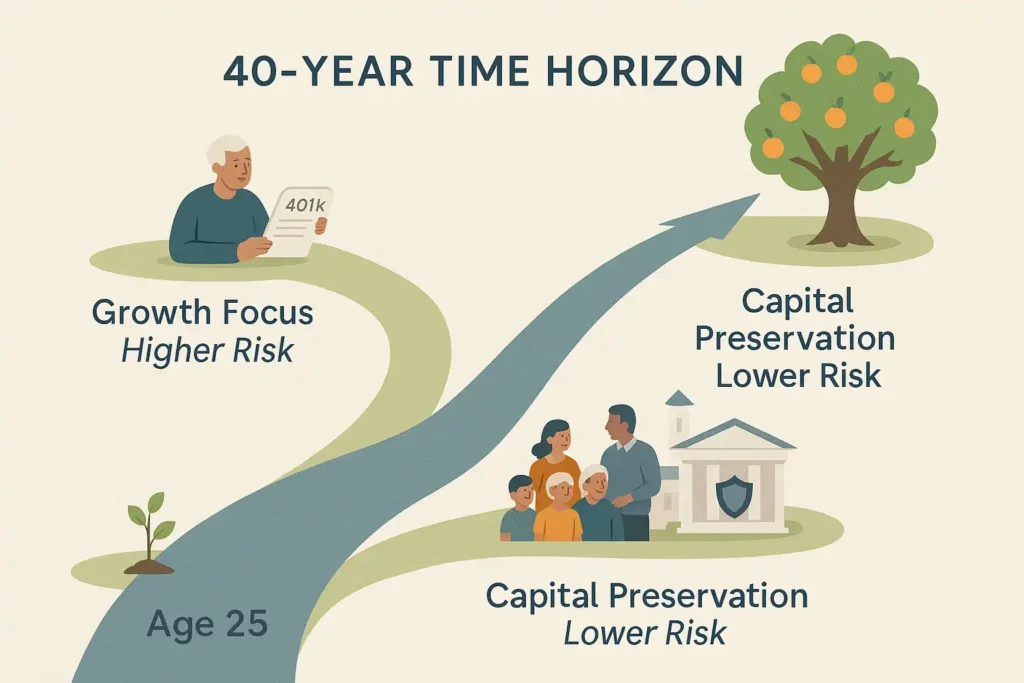

- The Accumulation Time Horizon: This is the period when you are working and saving for retirement. For a 25-year-old, this time horizon is roughly 40 years. For a 50-year-old, it might be 15 years.

- The Decumulation Time Horizon: This is the period during retirement when you are withdrawing money to live on. This is often referred to as your retirement time horizon, and it could also be very long – potentially 30 years or more.

For early planning, we’re primarily focused on the first one: your accumulation time horizon.

Why Your Time Horizon is a Superpower (Especially When It’s Long)

A long accumulation time horizon (e.g., 30-40 years) is your greatest financial asset. Here’s why:

- It Allows for Higher Risk (and Higher Potential Returns): The stock market is volatile in the short term, with ups and downs. However, over long periods, it has historically provided much higher returns than safer investments like bonds or cash. With a long time horizon, you have decades to recover from any market downturns, allowing you to invest more heavily in growth assets like stocks.

- It Maximizes Compound Interest: Compounding needs time to work its magic. A longer time horizon means your investment returns have more years to generate their own returns, leading to exponential growth. (Link to 1.2 when created)

- It Smooths Out Volatility: A bad year or two in the market has very little impact on a 40-year plan. A long time horizon allows you to ride out the bumps and benefit from the market’s long-term upward trend.

How Time Horizon Shapes Your Strategy:

- A Young Investor (Long Time Horizon): Can have a portfolio heavily weighted towards stocks (e.g., 80-90%) because they have ample time to recover from downturns and seek maximum long-term growth.

- An Investor Nearing Retirement (Shorter Time Horizon): Needs to protect their accumulated savings. They can’t afford a major market crash right before they need the money. Their strategy will shift to include more conservative investments like bonds to reduce volatility. This is known as a “glide path.” (Link to 3.21 when created)

- A Retiree (Decumulation Time Horizon): Still has a multi-decade time horizon! This means even retirees shouldn’t abandon growth investments entirely, as they need their portfolio to continue growing faster than inflation to last for the rest of their lives.

Conclusion

Understanding your time horizon is the essential first step in crafting an appropriate retirement savings and investment strategy. If you’re young, recognize that your long time horizon is a superpower that allows you to embrace growth-oriented investments and fully leverage the power of compounding. As you get closer to retirement, your time horizon shortens, and your strategy will naturally evolve to become more conservative. By aligning your investment choices with your time horizon, you put yourself on the right path to reaching your long-term financial goals.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸