Contents

Audio Podcast on Retirement Longevity: Planning for a Decades-Long Future

When you first start thinking about the core concept of retirement planning, you might focus on reaching a certain age, like 65. But retirement isn’t just a finish line; it’s the start of a new phase of life that could last much longer than you think. One of the most critical, yet often underestimated, aspects of planning is longevity – accurately estimating how long your retirement might actually last. Planning for only 10 or 15 years could leave you facing the significant risk of running out of money in your later years.

The Reality: We’re Living Longer

Thanks to advances in healthcare and lifestyle improvements, average life expectancies have increased significantly.

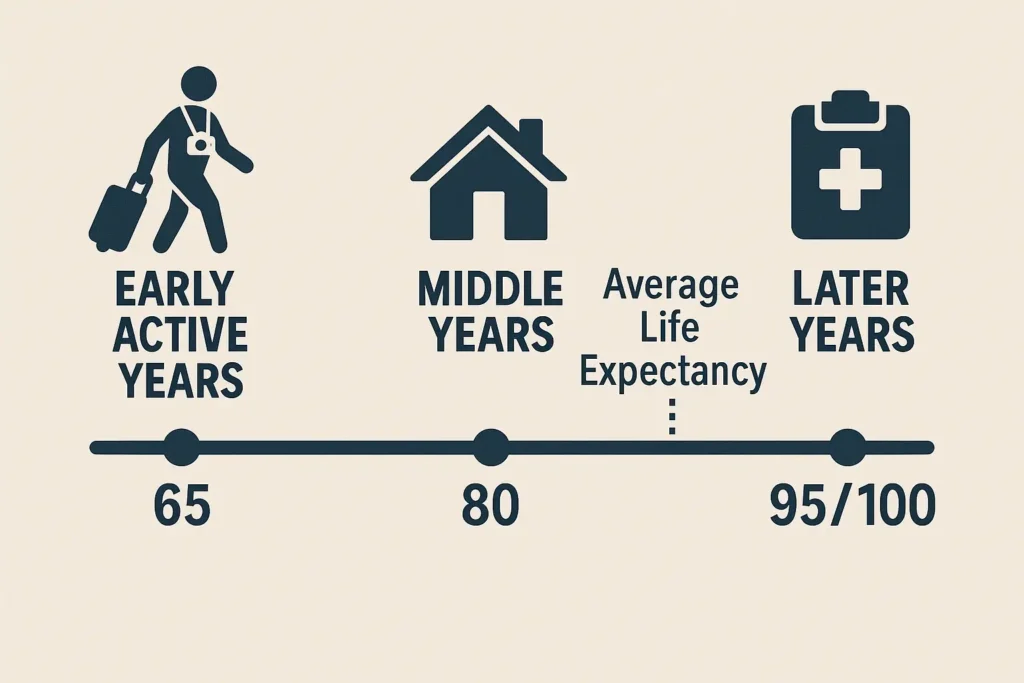

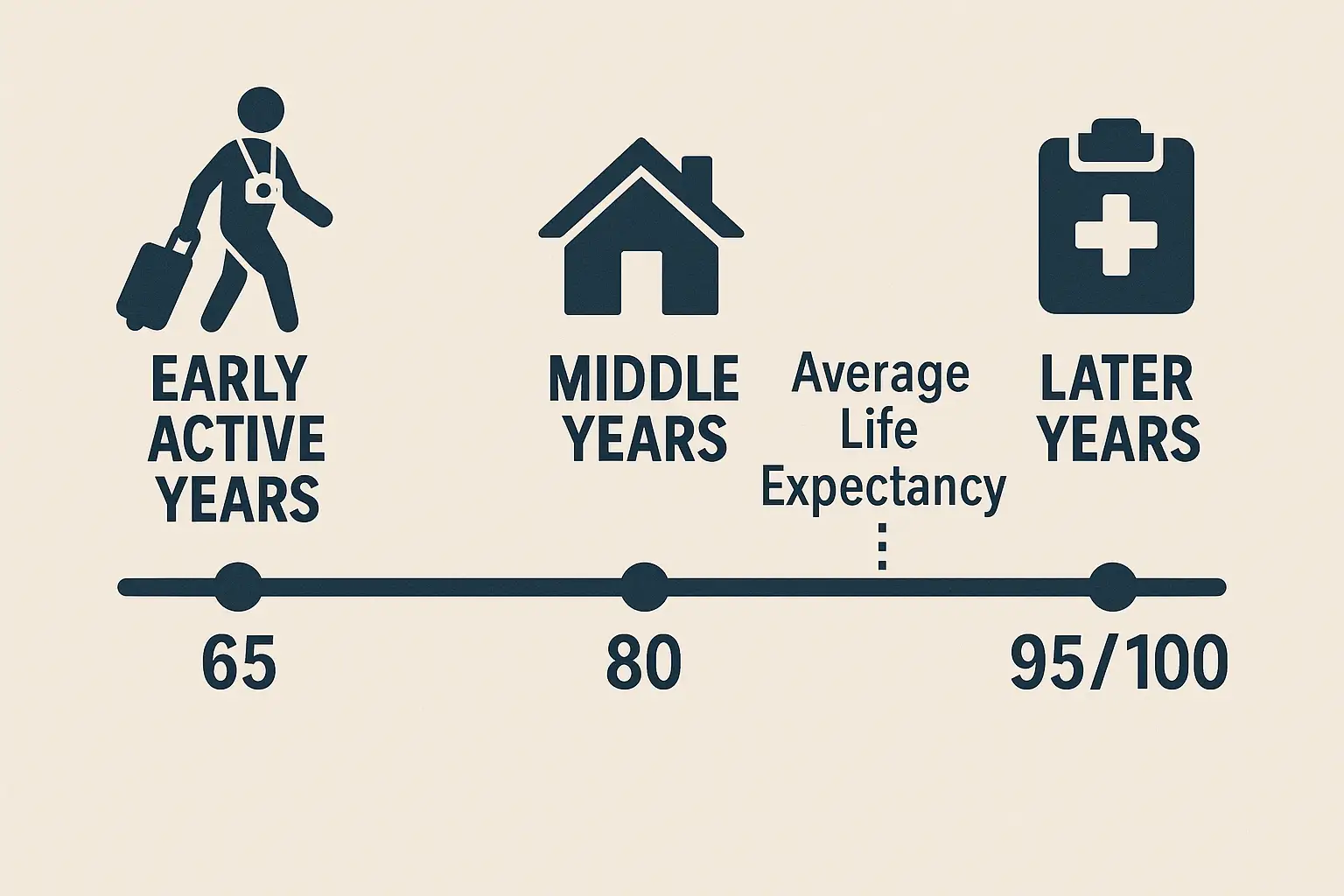

- Someone reaching age 65 today can, on average, expect to live well into their 80s.

- For a couple reaching age 65, there’s a high probability that at least one partner will live into their 90s.

- It’s increasingly important to plan for the possibility of living to 95 or even 100.

While these are averages (your personal health, family history, and lifestyle play a role), planning based only on average life expectancy is risky. You need to plan for the possibility of living longer than average.

Why Longevity Matters So Much in Planning

- Duration of Income Needs: A longer retirement means your savings need to provide income for more years. A plan sufficient for 15 years might be completely inadequate for 30 years.

- Impact of Inflation: The longer your retirement, the more significantly inflation erodes the purchasing power of your savings and fixed income sources. (Link to 4.17 when created)

- Healthcare Costs: Longer lifespans often mean more years of potentially high healthcare costs, including the increasing likelihood of needing expensive long-term care later in life. (Link to 3.11 when created)

- Withdrawal Strategy: Withdrawal rate guidelines (Link to 3.10 when created) like the 4% rule are often based on a 30-year retirement. If your timeline might be longer, a more conservative withdrawal rate might be necessary.

- Investment Horizon: Even in retirement, a long potential lifespan means you likely need to maintain some growth assets (like stocks) in your portfolio to outpace inflation, rather than shifting entirely to conservative investments too early.

How to Plan for Longevity

- Use Realistic Timeframes: When using retirement calculators or creating projections, plan for your funds to last until at least age 90 or 95, especially if you are healthy or have a family history of longevity.

- Be Conservative with Withdrawals: Consider starting with a withdrawal rate slightly lower than standard guidelines if you anticipate a very long retirement.

- Maximize Social Security: Delaying Social Security benefits until age 70 provides a larger, inflation-adjusted income stream guaranteed for life – excellent longevity protection. (Link to 3.7 when created)

- Consider Longevity Annuities (DIAs/QLACs): These specialized annuities can provide income starting later in life (e.g., age 85), acting as insurance against outliving other assets. (Link to 5.18 when created)

- Factor in Rising Healthcare Costs: Build realistic estimates for healthcare and potential long-term care into your expense projections.

- Maintain Portfolio Growth Potential: Don’t de-risk your portfolio too drastically too soon. You still need growth to sustain income over decades.

- Build Flexibility: Have contingency plans (like reducing discretionary spending) if you live longer than expected or face unexpected costs.

Conclusion

Retirement isn’t a short sprint; for many, it’s a marathon lasting decades. Failing to plan for longevity is one of the biggest potential pitfalls in planning for retirement income. By using realistic time horizons (planning to age 90/95+), employing strategies that provide lifetime income (like maximizing Social Security), and building flexibility into your plan, you significantly increase the odds that your financial resources will last as long as you do, allowing you to enjoy your entire retirement with security and peace of mind.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸

1 thought on “Planning for Decades: Why Understanding Retirement Longevity is Crucial”