Contents

Audio Podcast on Healthcare Costs in Retirement Planning

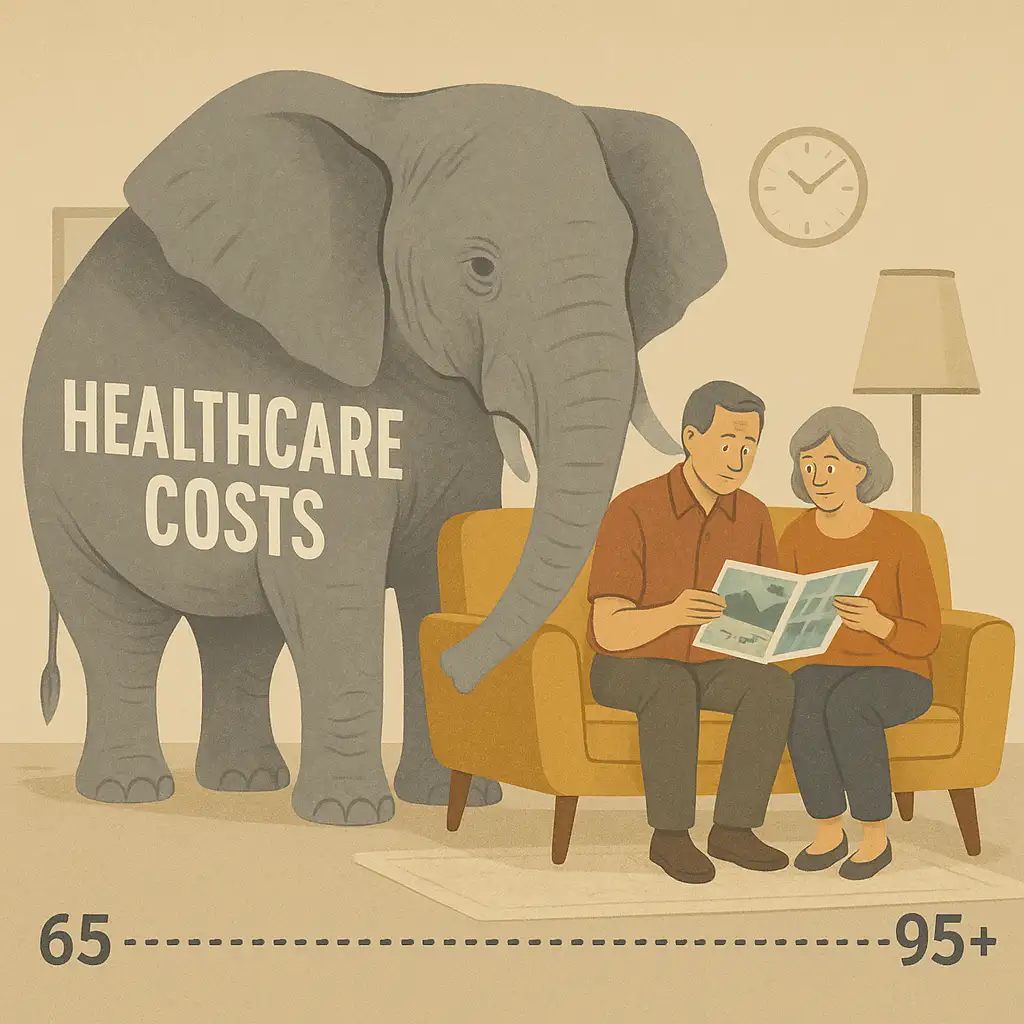

When envisioning retirement, most people focus on funding lifestyle goals like travel, hobbies, or simply relaxing. While these are important, one of the largest, most unpredictable, and often underestimated expenses retirees face is healthcare. Incorporating realistic projections for medical costs is an absolutely essential part of the core concept of retirement planning, yet it’s frequently overlooked, especially in the early stages. Ignoring potential healthcare expenses can put your entire retirement plan at risk.

Why Healthcare Costs Deserve Special Attention

- They Are Significant: Studies consistently show that healthcare will be one of the largest expenses for retirees. Estimates for the total lifetime healthcare costs for a couple retiring today often run into the hundreds of thousands of dollars – excluding potential long-term care costs.

- Medicare Isn’t Free (or Comprehensive): While Medicare coverage (Link to 3.12 when created) provides a crucial foundation starting at age 65, it’s not free. You’ll still pay premiums (especially for Part B and D), deductibles, and co-pays. Furthermore, Medicare doesn’t cover everything; notable exclusions include most dental care, vision, hearing aids, and, critically, most long-term care costs (Link to 3.14 when created).

- Costs Tend to Rise with Age: As we get older, health issues often become more frequent and complex, leading to higher utilization of medical services and potentially higher out-of-pocket costs. This is compounded by planning for a long retirement.

- Healthcare Inflation is High: Historically, the cost of medical care has risen faster than general inflation, meaning these expenses take an increasingly larger bite out of retirement budgets over time.

- Unpredictability: While you can estimate average costs, a sudden major illness or accident can lead to unexpectedly high bills, even with good insurance coverage.

Incorporating Healthcare into Early Planning

Even if retirement is decades away, acknowledging future healthcare costs is vital now:

- Motivates Higher Savings Goals: Recognizing this significant future expense underscores the need to save diligently and aim for a robust retirement nest egg. It combats the myth that you might not need substantial savings.

- Highlights the Value of HSAs: If you’re eligible for a Health Savings Account (HSA) through a High-Deductible Health Plan (HDHP), contributing consistently and investing the funds creates a dedicated, triple-tax-advantaged pool specifically for future medical expenses. (Link to 2.24 when created)

- Informs Investment Strategy: The need to cover potentially large, inflating healthcare costs reinforces the importance of long-term investment growth that outpaces medical inflation.

- Shapes Long-Term Care Considerations: Even early on, understanding that Medicare likely won’t cover LTC prompts initial thought about how such care might eventually be funded (insurance, self-funding).

Conclusion

Don’t let healthcare costs be the elephant in your retirement planning room. While precise figures are hard to predict decades out, acknowledging that significant medical expenses are a near certainty in retirement is crucial. This understanding should motivate you to save more diligently, utilize tools like HSAs if possible, and factor healthcare into your long-term financial projections. Properly planning for healthcare costs in retirement (Link to 3.11 when created) is not just about budgeting; it’s about ensuring your health needs don’t derail your financial security later in life.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸

2 thoughts on “Healthcare Costs: The Elephant in the Retirement Planning Room”