Contents

Audio Podcast on Retirement Planning: Solo vs. Couple Strategies

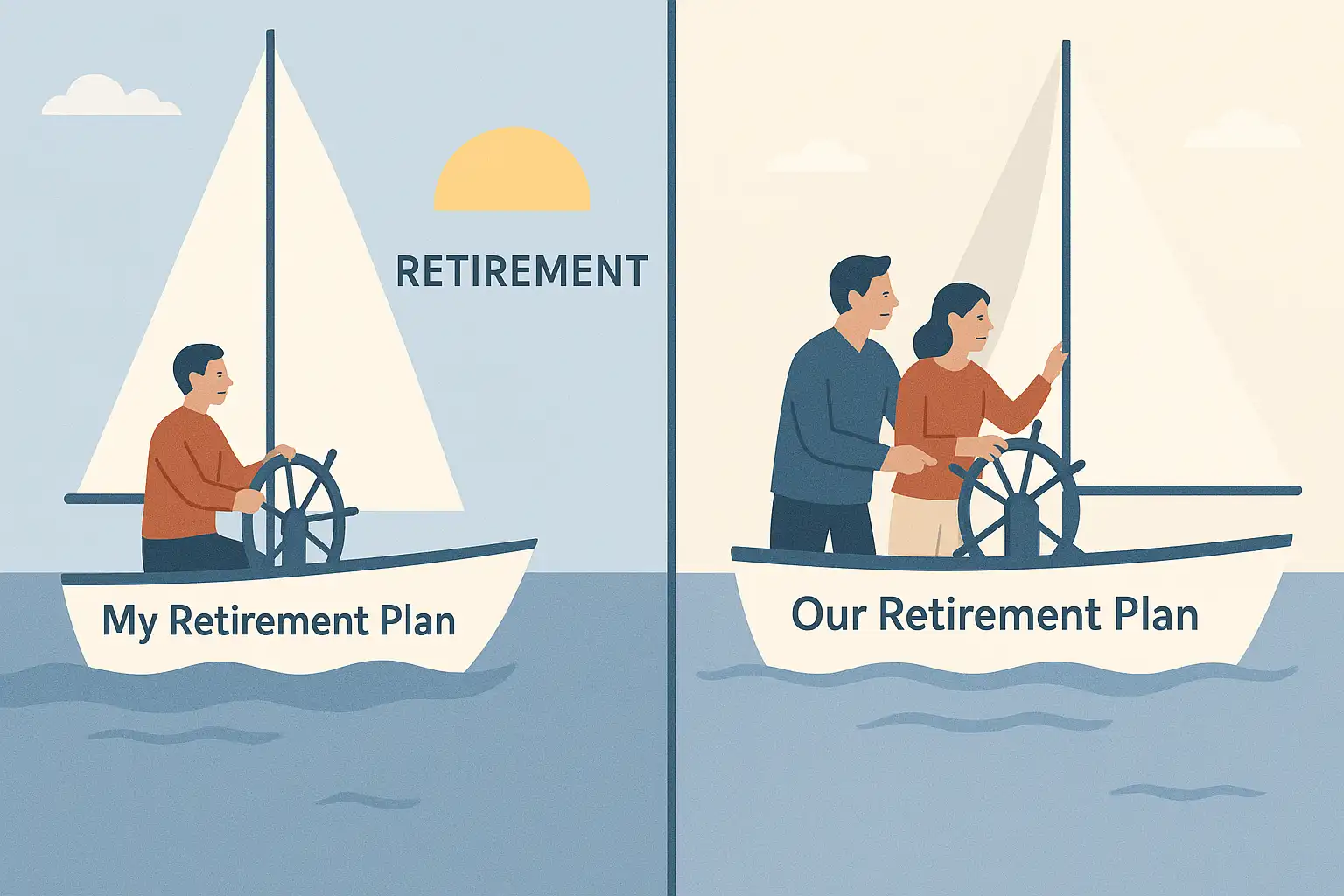

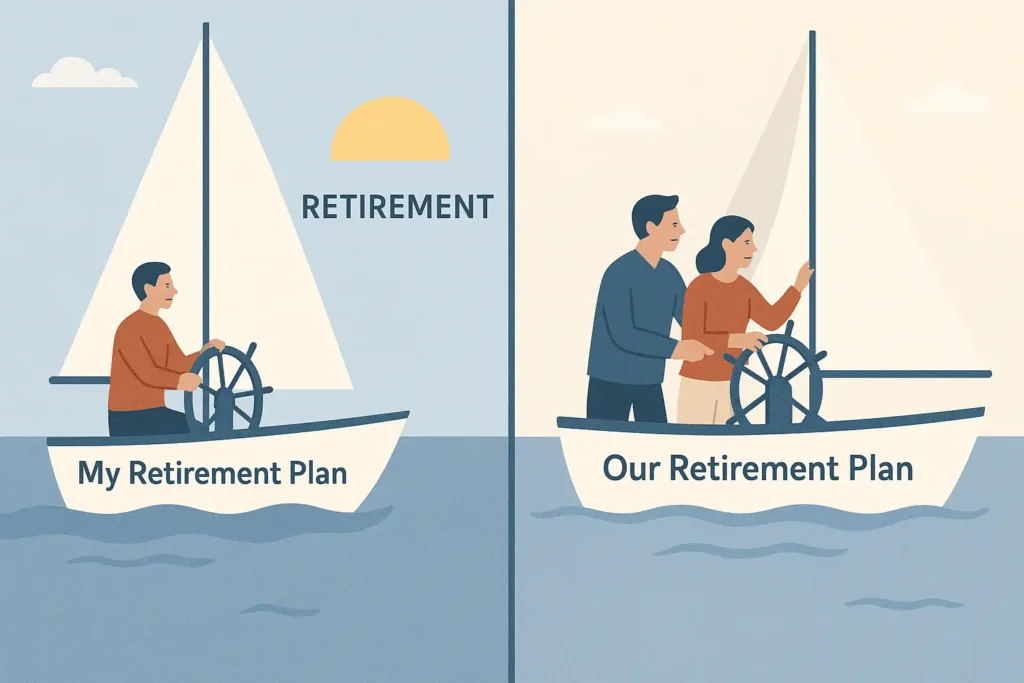

The fundamentals of starting retirement planning early – saving consistently, leveraging compounding, understanding basics – apply to everyone. However, your relationship status can influence certain aspects of your approach, especially in the initial stages. Whether you’re single or part of a married couple, understanding these subtle differences helps tailor your strategy effectively within the core concept of retirement planning.

Planning as a Single Individual

- Sole Responsibility: The biggest difference is that the entire responsibility for saving and planning rests on your shoulders. There’s no partner’s income or savings to potentially fall back on or coordinate with.

- Undivided Focus: You have complete control over your financial decisions, budgeting priorities, and investment choices without needing to compromise or align with a partner’s potentially different risk tolerance or goals.

- Goal Setting is Personal: Your retirement vision and savings targets are based solely on your individual needs and desires. (Link to 1.3 when created)

- Account Simplicity: You’ll primarily focus on your own employer plan (like a 401(k)) and your own Traditional or Roth IRA.

- Potential Challenge: Covering all expenses and savings goals on a single income can be more challenging. Budgeting discipline is key.

- Beneficiary Designations: Need to choose beneficiaries other than a spouse (family members, friends, charities).

Planning as a Married Couple

- Shared Responsibility & Goals: Ideally, retirement planning becomes a team effort. Couples need to discuss and align their individual and shared retirement visions, timelines, and spending expectations.

- Coordination is Key: You need to coordinate savings strategies across potentially two incomes and multiple retirement accounts (e.g., two 401(k)s, IRAs).

- Prioritization: Whose 401(k) match gets prioritized first if you can’t max both?

- Account Types: Does one partner benefit more from Roth vs. Traditional based on income?

- Overall Savings Rate: Calculating combined savings as a percentage of household income.

- Communication is Crucial: Open and honest communicating about finances (Link to 3.27 when created), risk tolerance, and goals is essential to avoid conflict and ensure you’re working together.

- Additional Savings Tools: Married couples have access to Spousal IRAs (Link to 1.8/1.9/1.10 when created), allowing a non-working or low-earning spouse to save for retirement based on the working spouse’s income.

- Combined Financial Picture: Decisions are often based on household income and expenses, potentially allowing for higher savings rates or different investment strategies than if single.

- Survivor Planning: Even early on, beneficiary designations usually involve naming the spouse, and understanding potential survivor benefits (Social Security, pensions) becomes relevant long-term.

Similarities Outweigh Differences Early On

Despite these nuances, the core actions in your 20s and 30s are largely the same for both singles and couples:

- Start saving consistently, as early as possible.

- Prioritize getting any available employer match.

- Understand compound interest and basic investment concepts.

- Choose appropriate retirement accounts (401(k), IRA).

- Live below your means to free up money for saving.

Conclusion

Whether single or married, the fundamental principles of early retirement planning remain the same: start early, save consistently, and invest wisely. Singles have sole responsibility and control, while couples benefit from potential combined resources but require communication and coordination. Understanding your specific situation allows you to leverage the right tools (like Spousal IRAs for couples) and tailor your approach, but the most important step, regardless of relationship status, is simply to begin.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸