Contents

Audio Podcast on Retirement’s Stages: From Saving to Spending

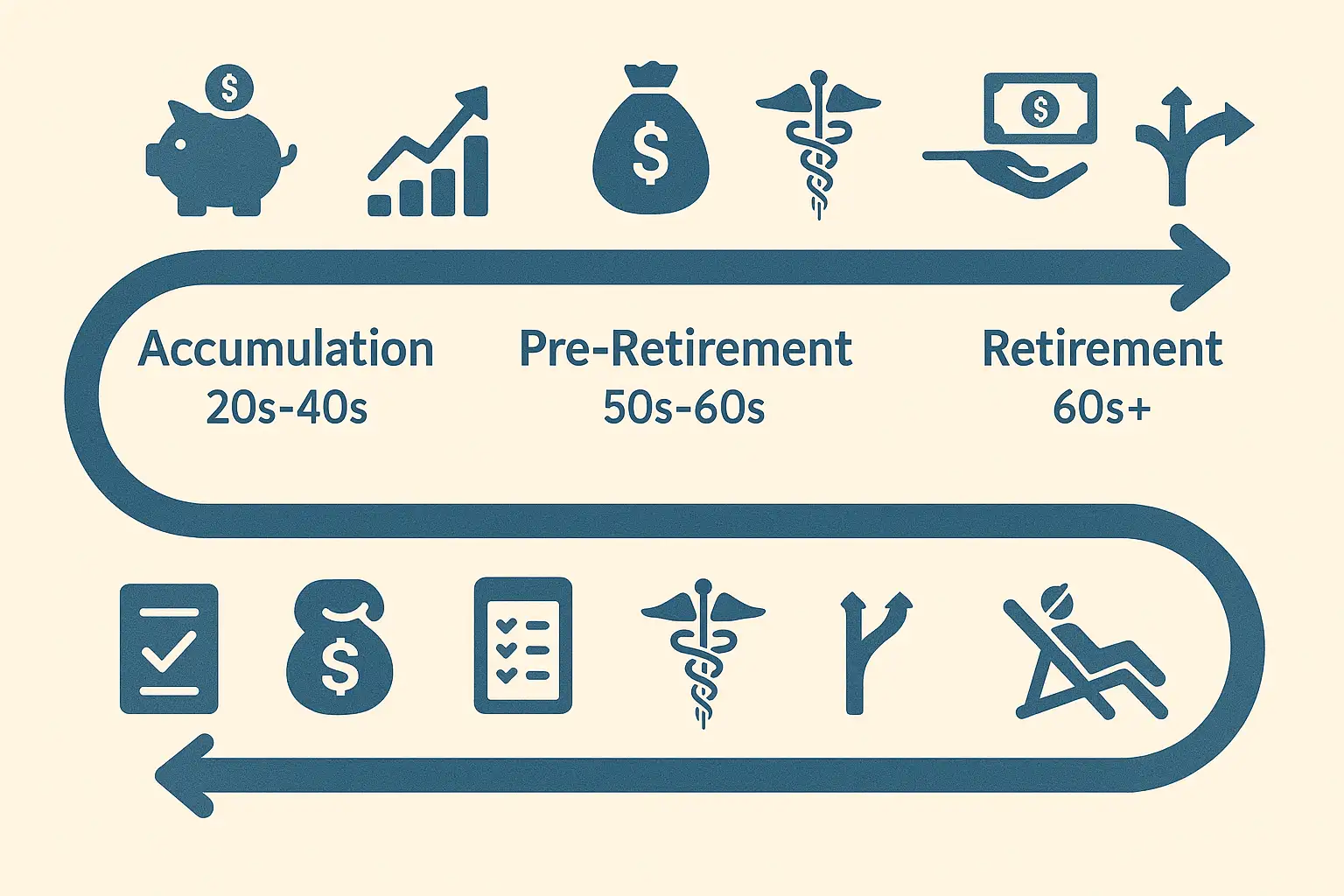

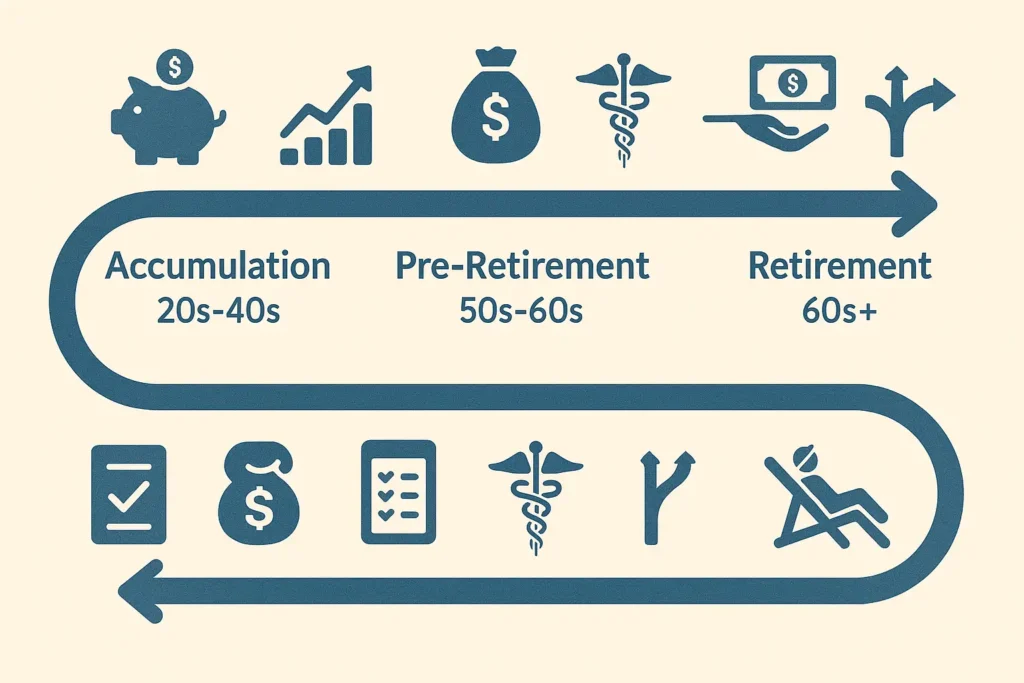

Retirement planning isn’t a single event; it’s a lifelong journey with distinct phases. Just as your life evolves, so too should your financial strategies. Understanding the main stages of a typical retirement plan lifecycle helps you focus on the right priorities at the right time, ensuring a smoother transition and a more secure future. Recognizing which stage you’re in is fundamental to the core concept of retirement planning.

The Three Main Stages of Retirement Planning

While everyone’s path is unique, most people progress through these broad stages:

Stage 1: Early Career / Accumulation Stage (Roughly 20s to 40s)

- Focus: Building the foundation and maximizing growth.

- Priorities:

- Starting Early: Establishing the habit of saving consistently.

- Leveraging Time: Taking advantage of decades of compound growth potential. (Link to 1.2 when created)

- Capturing Employer Match: Getting the full “free money” from 401(k) matches. (Link to 1.11 when created)

- Learning Basics: Understanding different account types (401k, IRA) and basic investment concepts. (Link to 1.6, 1.17 when created)

- Growth-Oriented Investing: Typically involves a higher allocation to stocks due to the long time horizon and ability to weather market volatility. (Link to 1.18 when created)

- Managing Debt: Balancing retirement savings with paying down high-interest debt like credit cards or student loans. (Link to 1.22 when created)

- Goal: Accumulate as large a nest egg as possible through consistent saving and investment growth. This stage is covered in detail in Silo 1: Foundational Retirement Planning & Early Stages (Link to Silo 1 Pillar Page when created) and Silo 2: Retirement Savings & Investment Strategies (Link to Silo 2 Pillar Page when created).

Stage 2: Mid-to-Late Career / Pre-Retirement Stage (Roughly 50s to Early 60s)

- Focus: Accelerating savings, refining goals, and preparing for the transition.

- Priorities:

- Maximizing Contributions: Utilizing catch-up contributions (age 50+) to boost savings significantly. (Link to 3.4 when created)

- Refining Retirement Vision: Getting specific about desired lifestyle, location, and spending needs. (Link to 3.1 when created)

- Estimating Expenses: Creating detailed retirement budget projections. (Link to 3.2 when created)

- Planning Income Sources: Strategizing Social Security claiming, evaluating pension options. (Link to 3.6, 3.7, 3.5 when created)

- Healthcare Planning: Understanding Medicare and planning for supplemental coverage and costs. (Link to 3.11, 3.12, 3.13 when created)

- Gradual De-Risking: Potentially shifting portfolio allocation slightly towards more conservative assets to protect accumulated savings from sequence risk. (Link to 3.21 when created)

- Consolidating Accounts: Simplifying finances before retirement. (Link to 3.17 when created)

- Goal: Solidify the financial plan, make key decisions about income sources and healthcare, and ensure assets are positioned appropriately for the transition to drawing income. This stage is covered in detail in Silo 3: Pre-Retirement & Transition Planning (Link to Silo 3 Pillar Page when created).

Stage 3: Retirement / Decumulation Stage (Roughly 60s Onward)

- Focus: Managing income streams and making savings last throughout retirement.

- Priorities:

- Implementing Withdrawal Strategy: Drawing income from portfolio sustainably. (Link to 4.2 when created)

- Managing Income Sources: Coordinating Social Security, pensions, portfolio withdrawals. (Link to 4.9, 4.10 when created)

- Budgeting & Expense Management: Living within the planned retirement budget. (Link to 4.1 when created)

- Tax Management: Minimizing taxes on retirement income. (Link to 4.7 when created)

- Healthcare Cost Management: Paying premiums, managing out-of-pocket costs. (Link to 4.11 when created)

- Ongoing Portfolio Management: Monitoring investments, potentially adjusting allocation over time. (Link to 4.18 when created)

- Longevity Planning: Ensuring assets last for potentially 30+ years.

- Estate Planning & Legacy: Reviewing estate documents, potentially focusing on wealth transfer. (Link to 4.22 when created)

- Goal: Generate reliable income to support desired lifestyle for the duration of retirement while managing risks like inflation, market downturns, and healthcare costs. This stage is covered in detail in Silo 4: Retirement Living & Income Management (Link to Silo 4 Pillar Page when created).

Conclusion

Retirement planning is a dynamic process that evolves throughout your life. By understanding whether you’re in the early accumulation stage, the pre-retirement transition phase, or the decumulation stage of retirement itself, you can focus your energy on the most relevant strategies and decisions. Recognizing these stages helps demystify the process and provides a clear roadmap for navigating your financial journey towards and through a secure retirement.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸