Contents

Audio Podcast on Start Now, Not Big: Early Retirement Savings

When it comes to planning for retirement, one of the biggest mental hurdles people face, especially early in their careers, is feeling like you don’t have enough to start (Link to 1.5 when created) saving meaningfully. Maybe you think, “I’ll wait until I get that raise,” or “I can only afford $50 a month, what’s the point?” This thinking, while understandable, overlooks the single most potent factor in successful long-term saving: time. Starting now, even with small amounts, is vastly more impactful than waiting to start big later on.

The Magic Ingredient: Compound Interest Needs Time

The reason starting early is so crucial boils down to the power of compound interest (Link to 1.2 when created). When you invest, your money earns returns. Compounding happens when those returns start earning their own returns. It creates a snowball effect, but snowballs need a long hill to gather significant size and momentum.

- Early Start, Long Runway: Starting in your 20s gives your money 40+ years to compound. Even small initial contributions have decades to grow exponentially.

- Later Start, Steep Climb: Waiting until your 40s cuts that compounding time in half or more. To reach the same goal, you’ll need to save significantly larger amounts each month, putting much more pressure on your budget later in life.

Illustrative Example (Simplified)

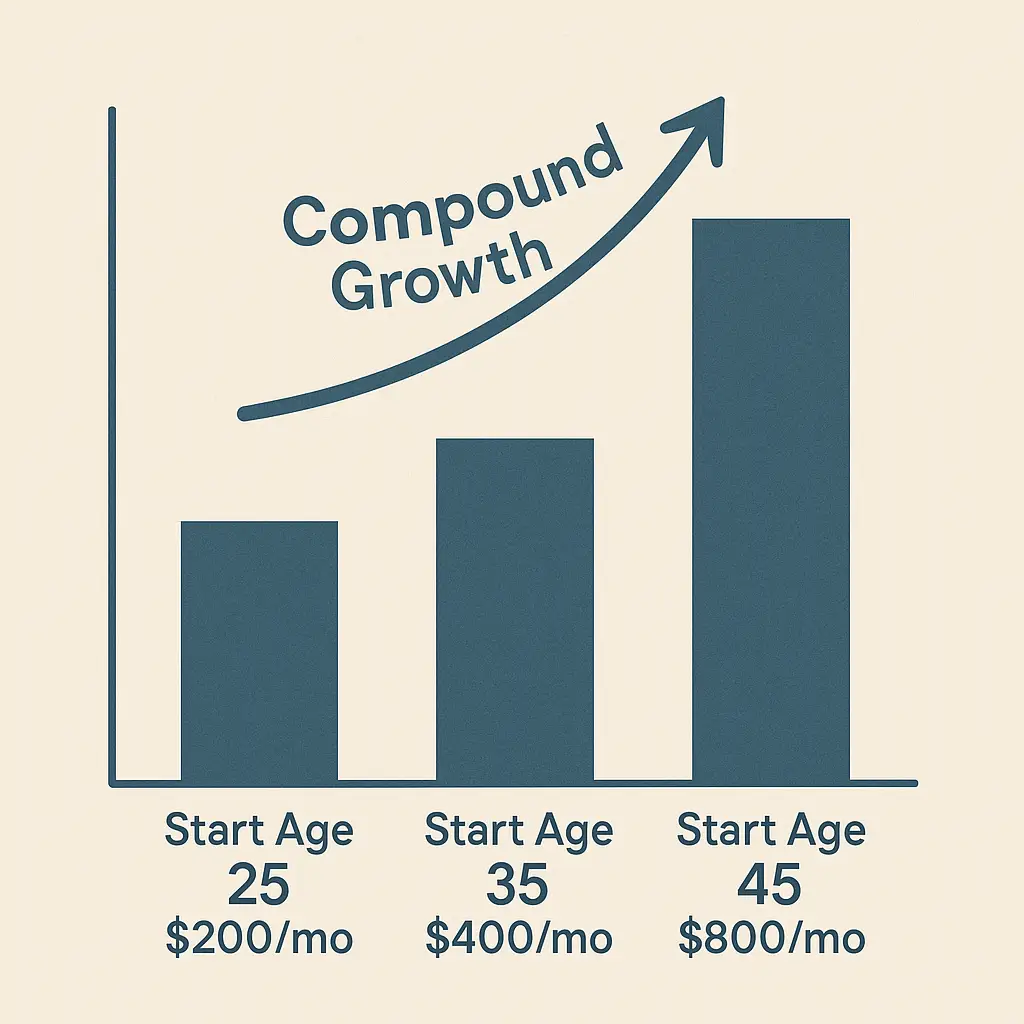

Imagine three savers aiming for retirement:

- Saver A (Starts Early): Saves $200/month from age 25 to 65 (40 years).

- Saver B (Starts Later): Saves $400/month from age 35 to 65 (30 years).

- Saver C (Starts Much Later): Saves $800/month from age 45 to 65 (20 years).

Assuming a hypothetical 7% average annual return, despite Saver B saving the same total amount out-of-pocket as Saver A over their career, and Saver C saving more out-of-pocket, Saver A (who started earliest with the smallest monthly amount) will likely end up with the largest nest egg due to the extra decade(s) of compounding.

(Note: This is illustrative; actual returns vary. The principle holds true.)

Beyond Compounding: Other Benefits of Starting Now

- Building the Habit: Consistency is key. Starting the habit of saving regularly, even small amounts, makes it easier to increase contributions later as your income grows. It becomes part of your routine.

- Capturing Employer Matches: If your employer offers a 401(k) match, starting contributions immediately ensures you don’t miss out on that “free money” from day one. (Link to 1.11 when created)

- Learning Curve: Starting early gives you more time to learn about investing, understand market cycles, and become comfortable with the process at lower stakes.

- Reduced Future Stress: Knowing you started early provides peace of mind and reduces the immense pressure of trying to play catch-up later.

How to Start Now (Even if Small)

- Contribute Something to 401(k): Even 1-2% of your paycheck gets you started, especially if it captures some employer match.

- Open an IRA: You can often open an IRA with no minimum and contribute small amounts regularly.

- Automate: Set up automatic transfers. Automating small contributions (Link to 1.16 when created) ensures it happens without you thinking about it.

- Use Windfalls: Direct small bonuses, tax refunds, or cash gifts towards your retirement savings.

Conclusion

Don’t let the perceived need to start “big” paralyze you from starting at all. When it comes to the core concept of retirement planning, time is your most valuable ally. Leveraging the power of compound interest over decades is far more effective than trying to make up for lost time with large contributions later. Start now, even if it’s just a small amount. Build the habit, be consistent, and let time work its magic for your future self.

👋 Hi, I’m Jaiveer Hooda, the content creator behind Grow Your Money Smart!

I’m passionate about exploring the world of personal finance and sharing actionable insights to help you manage debt, plan for a secure retirement, and create passive income streams. 💡 My goal is to simplify complex financial topics and empower you to make smarter money decisions.

Let’s grow your wealth together, one smart move at a time! 💸

2 thoughts on “Start Now, Not Big: The Unbeatable Advantage of Early Retirement Saving”